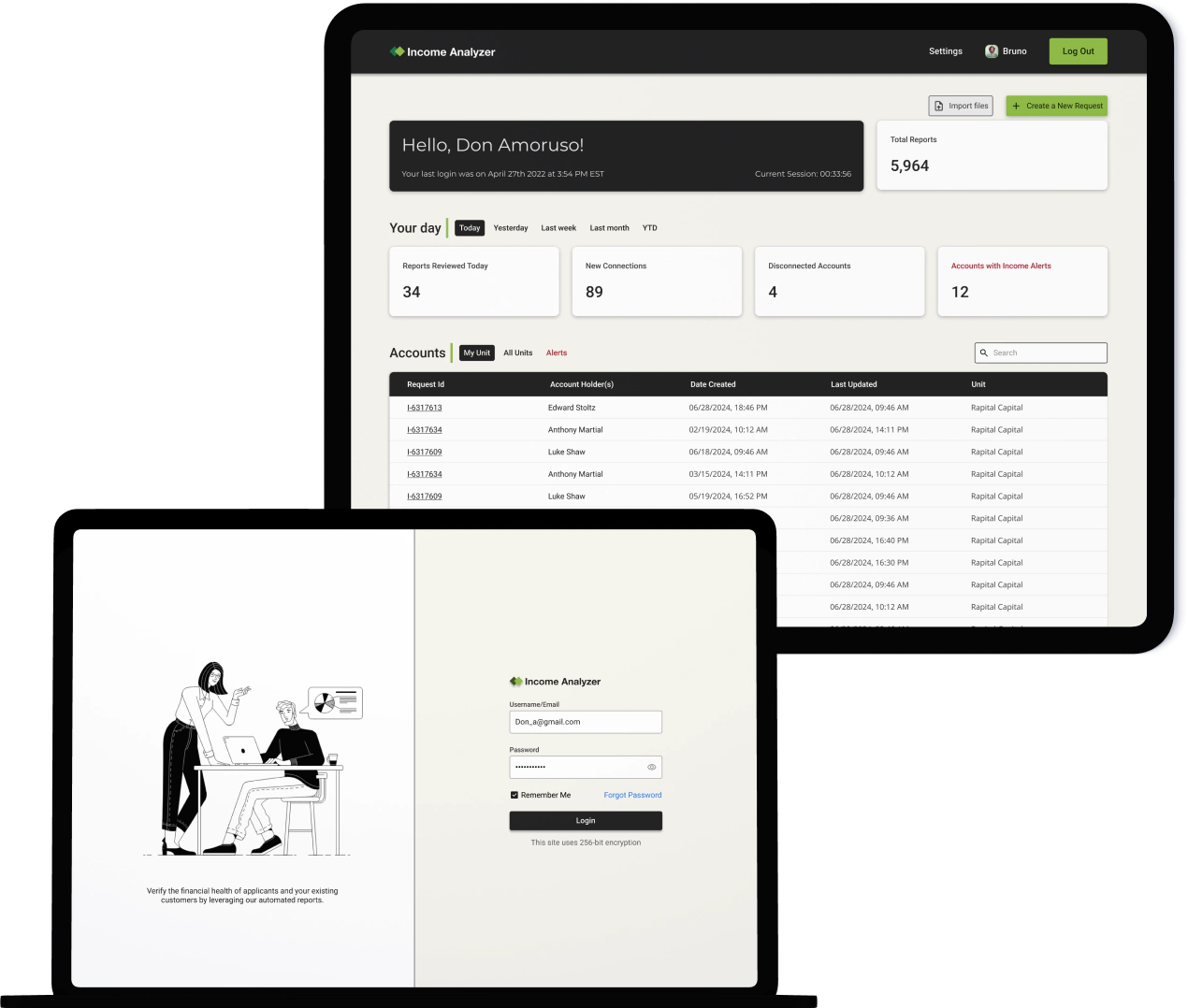

Web App

United States

FinTech

11-50 employees

- Single-page Application Using Svelte.js

- Client

- Agent

- Admin

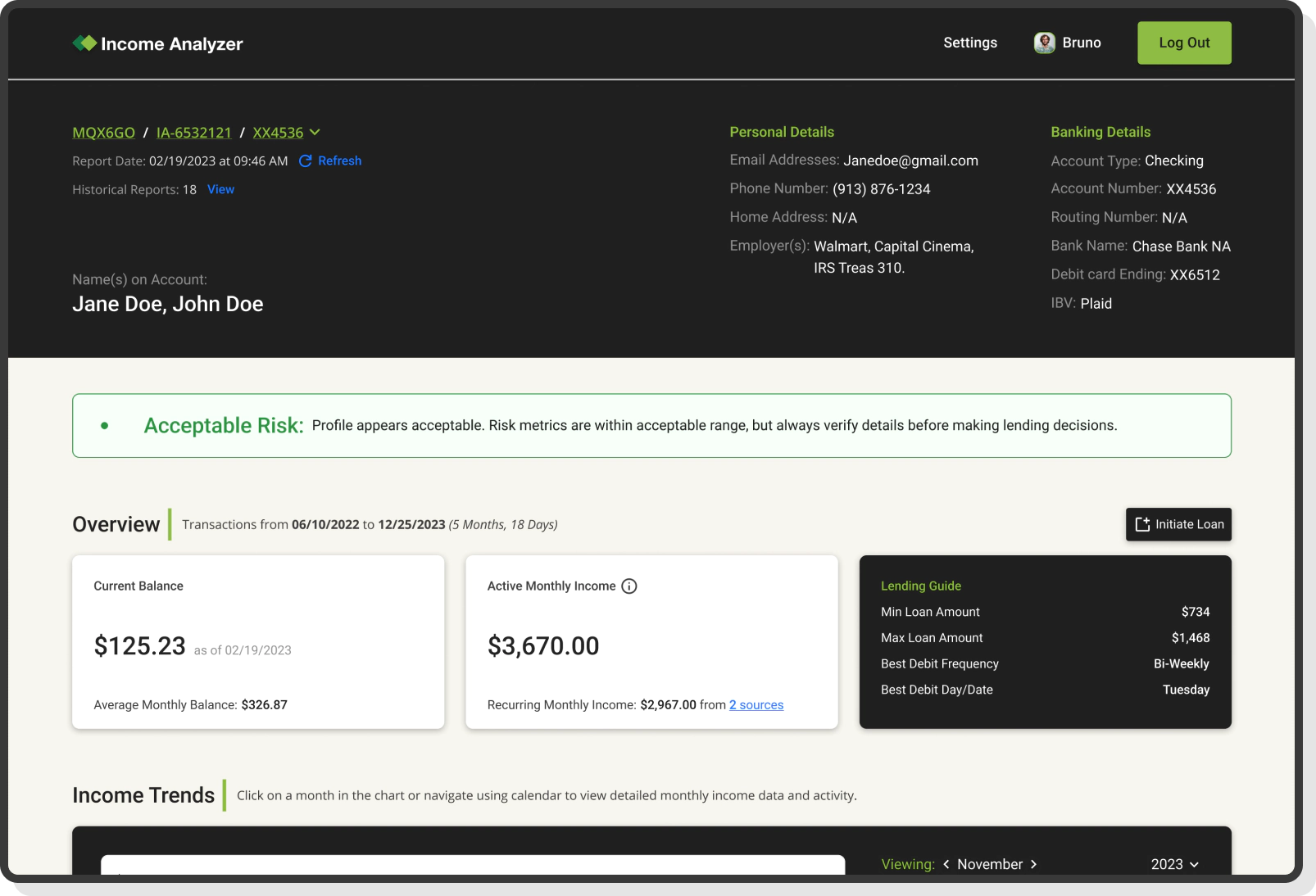

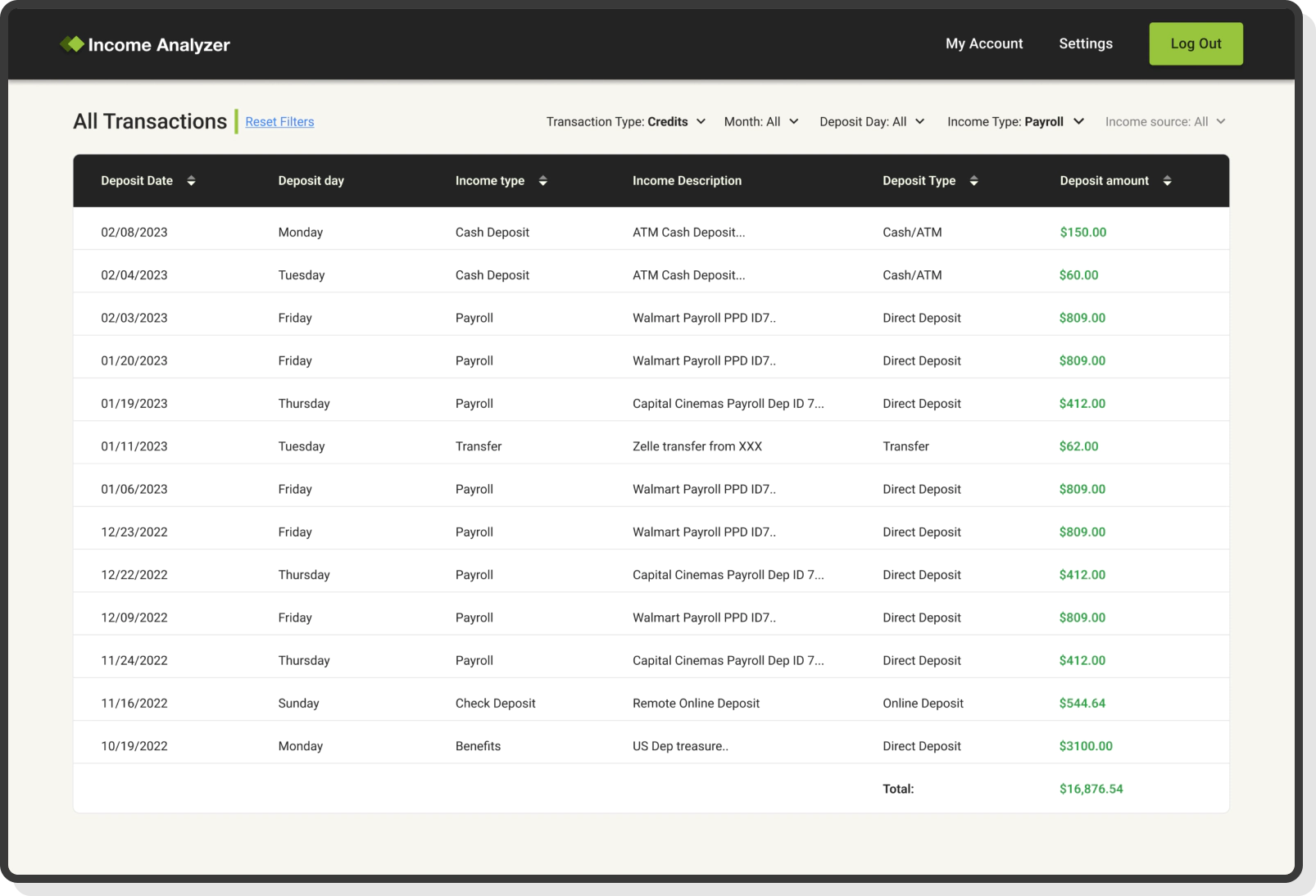

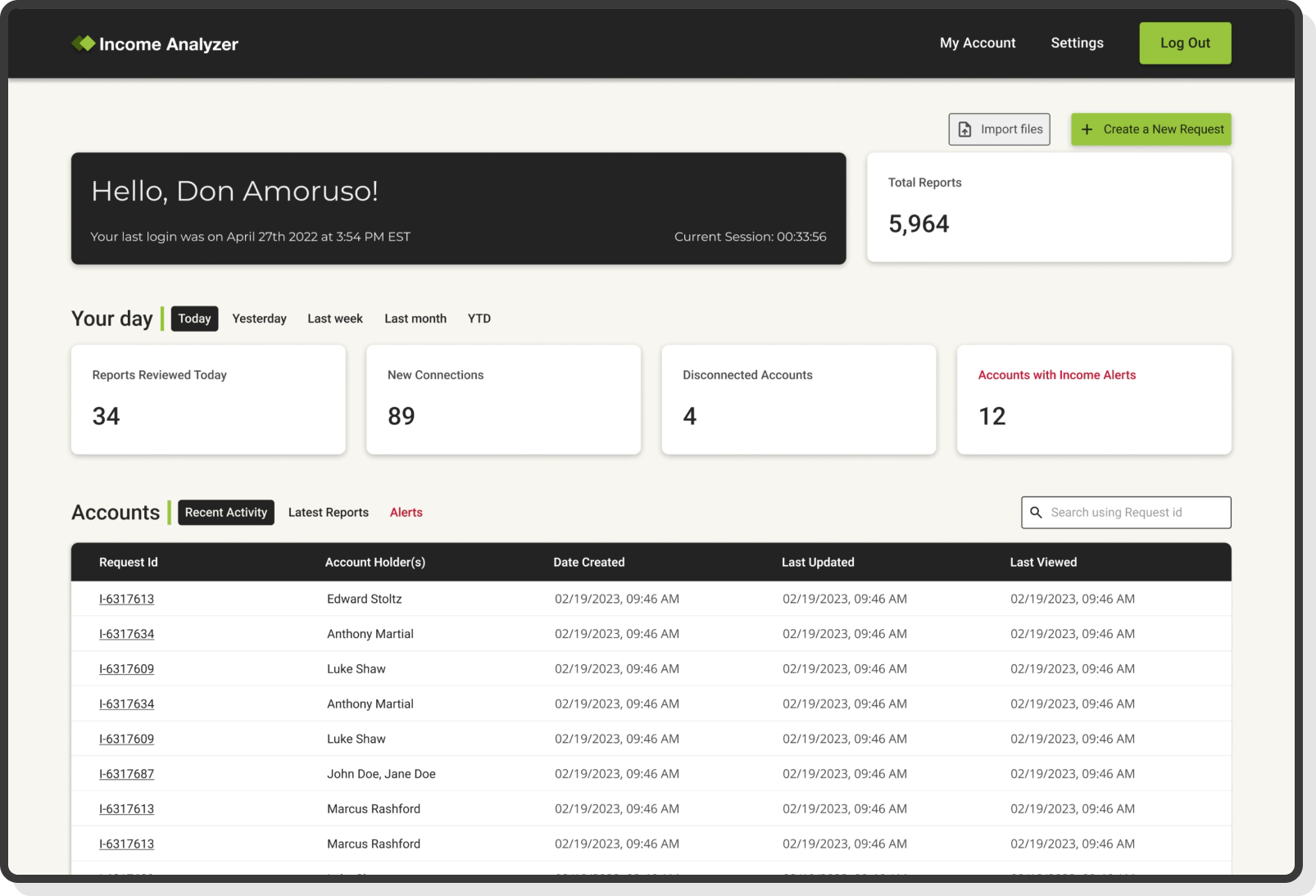

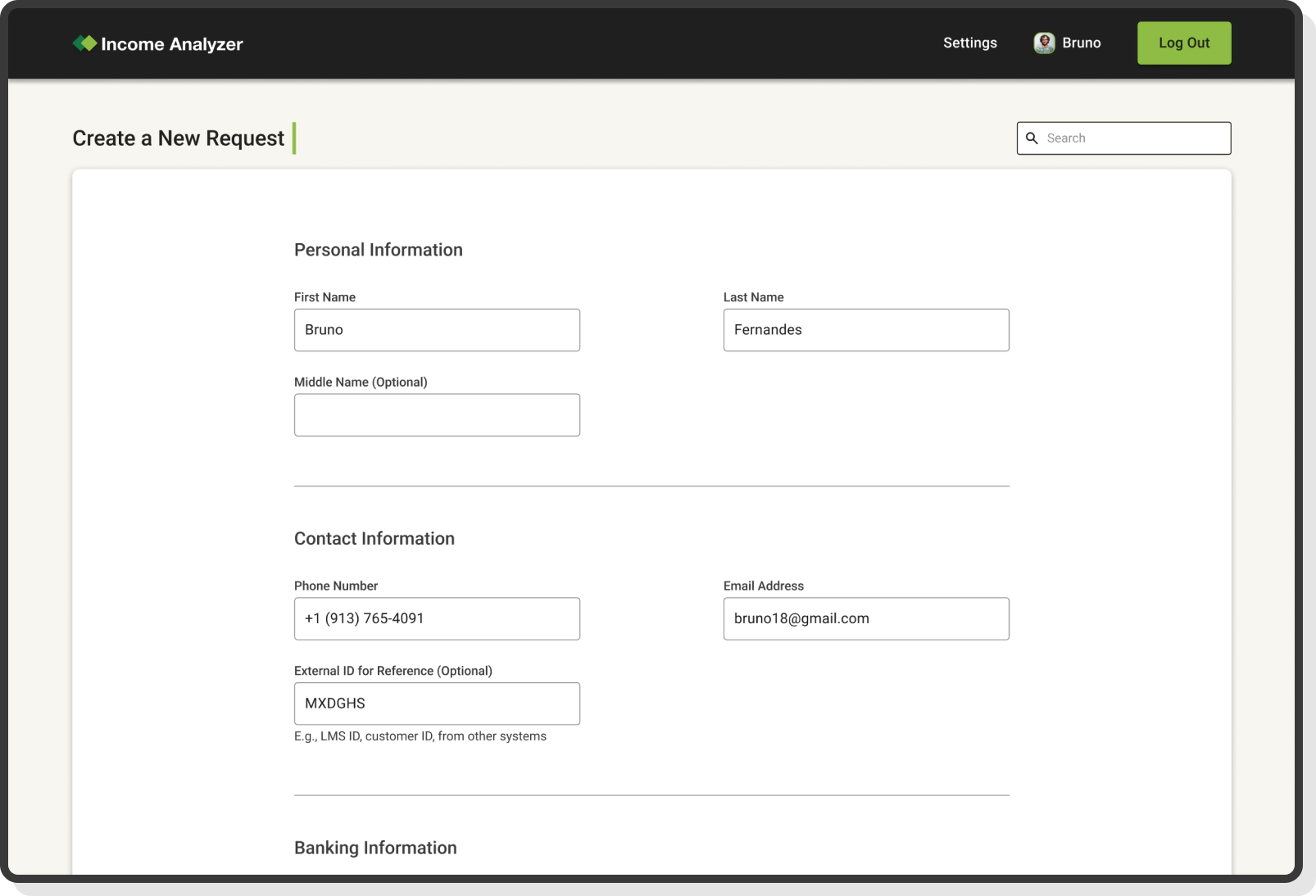

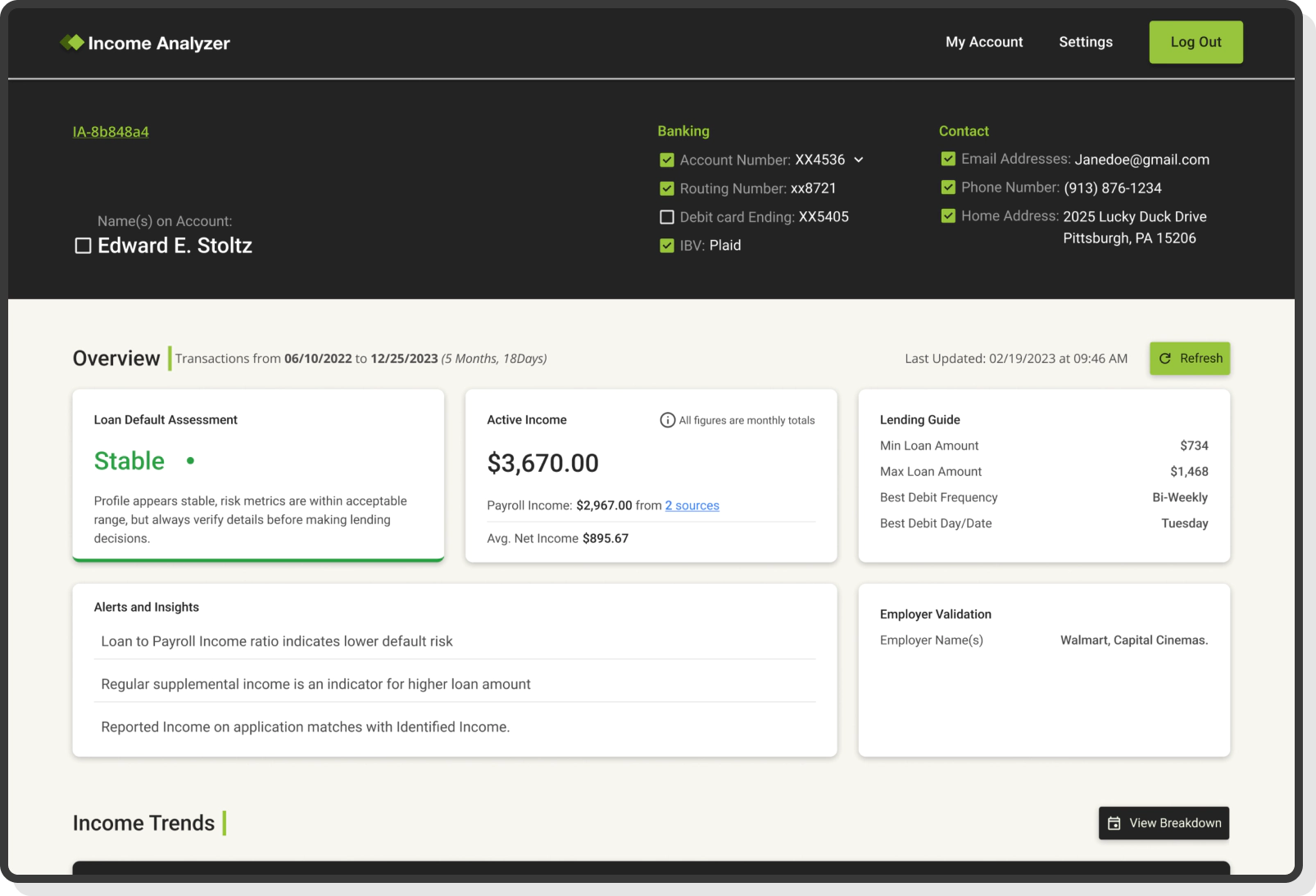

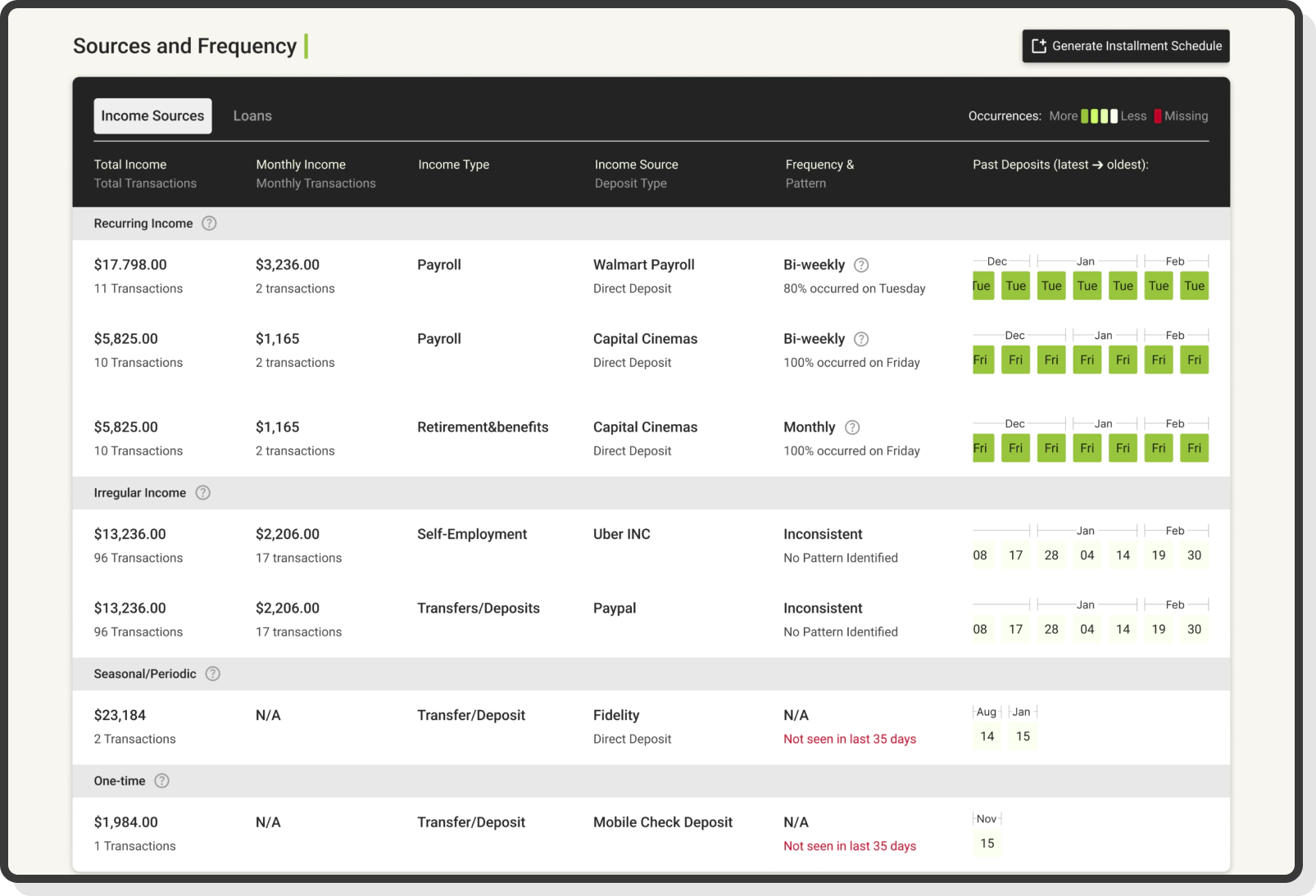

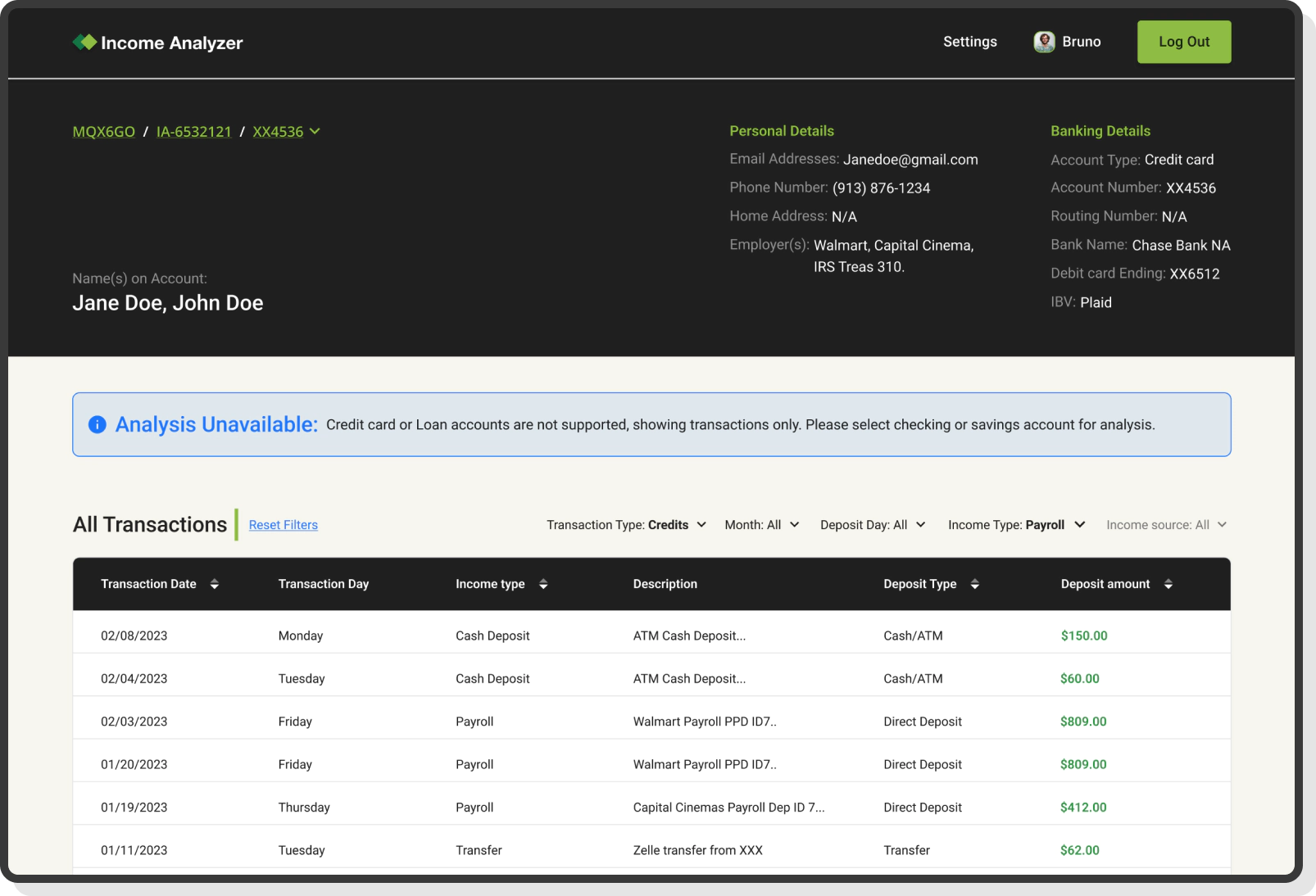

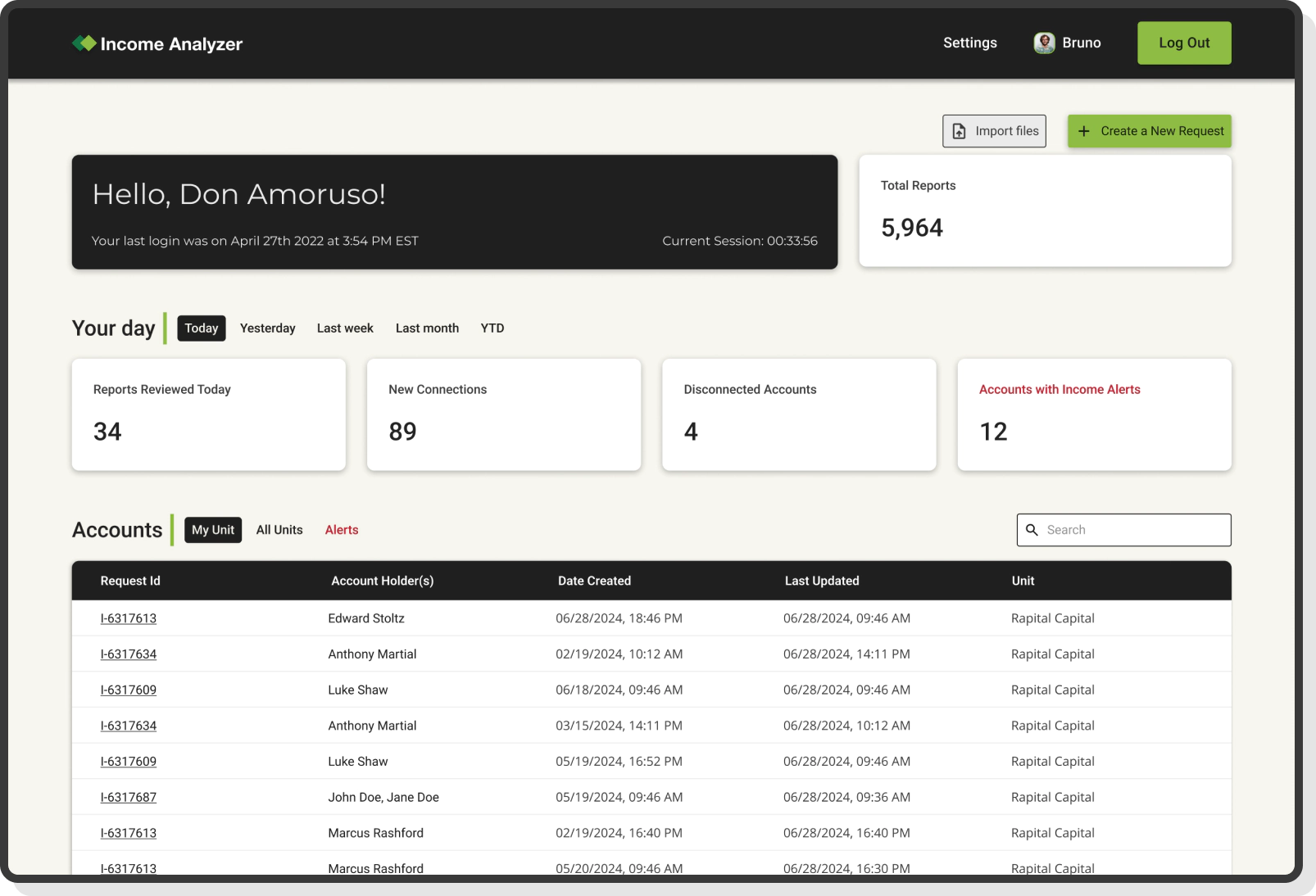

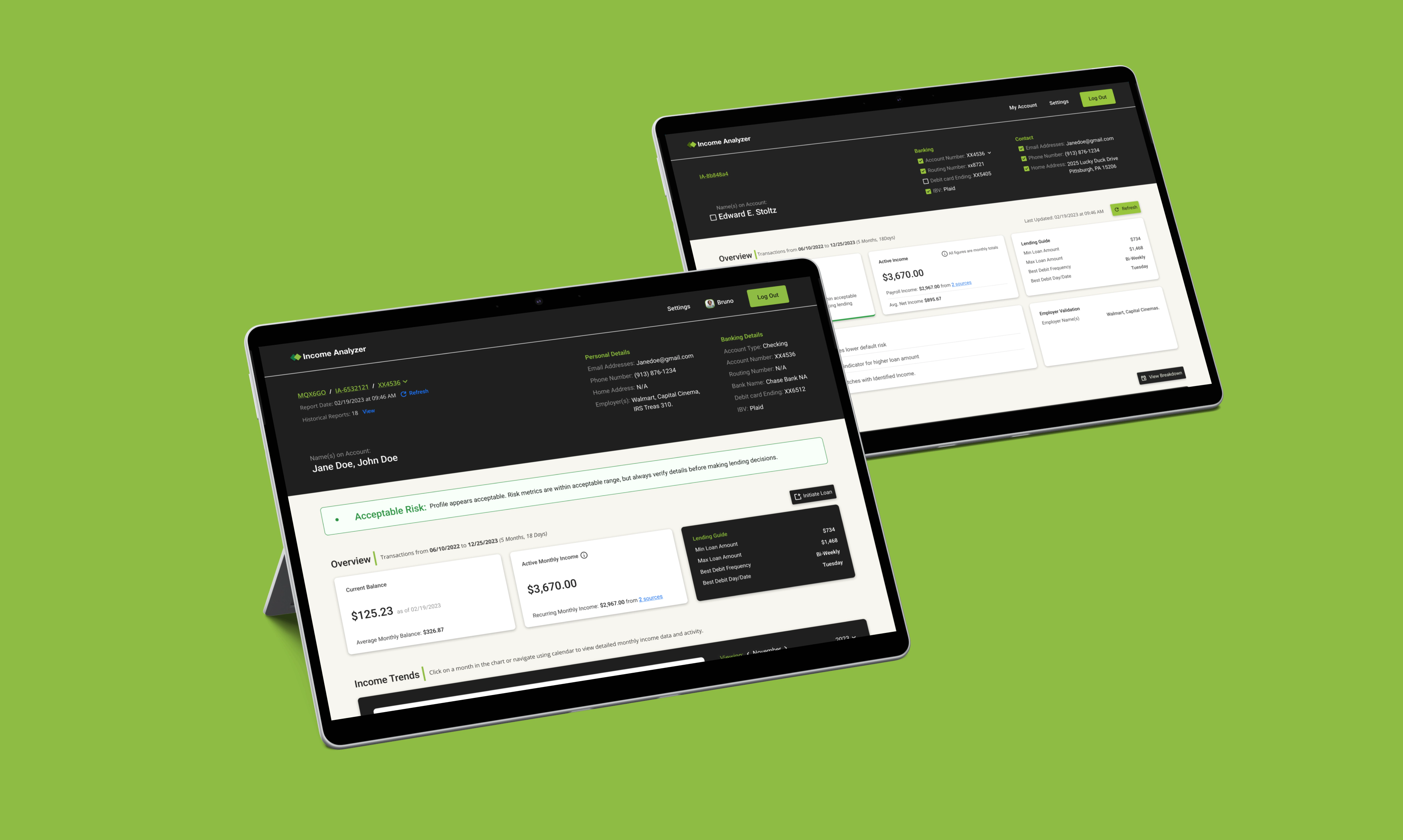

Developed by DMA Associates LLC, Income Analyzer is a powerful app that provides insights into income sources, types, frequencies, loss of income, employment verification, KYC, and an overall income health indicator. With a future income forecast, it empowers financial institutions, including lenders, property managers, and leasing companies, to adeptly evaluate high-risk customers seeking affordable credit.

- Advanced Income Pattern Analysis

- Empowering Financial Decision-Making

- Tailored for High-Risk Customer Assessment

- Future Income Forecasting

- Web Framework .NET Core

- UI Framework SvelteKit, Tailwind CSS

- Frontend Svelte

- Backend .NET Core

- Programming Language C#, JavaScript

- Database MySQL

- Design Tool Figma

- Third-Party Integration SvelteFlow

Based in the USA, income Analyzer is an intelligent application developed for DMA Associates LLC, a network of experts in providing FinTech solutions. It assists lenders, property managers, and leasing companies in assessing high-risk customers who are financially distressed and find it challenging to access affordable credit. By analyzing customers' bank account statement transaction data, the Income Analyzer provides insights into income patterns, including sources, types, frequencies, employment verification, and income health indicators.

Achieving accurate income analysis from complex transaction data.

Securing sensitive financial data to meet strict compliance needs.

Delivering real-time insights to speed up financial assessments.

Visualizing income trends clearly for better financial decisions.

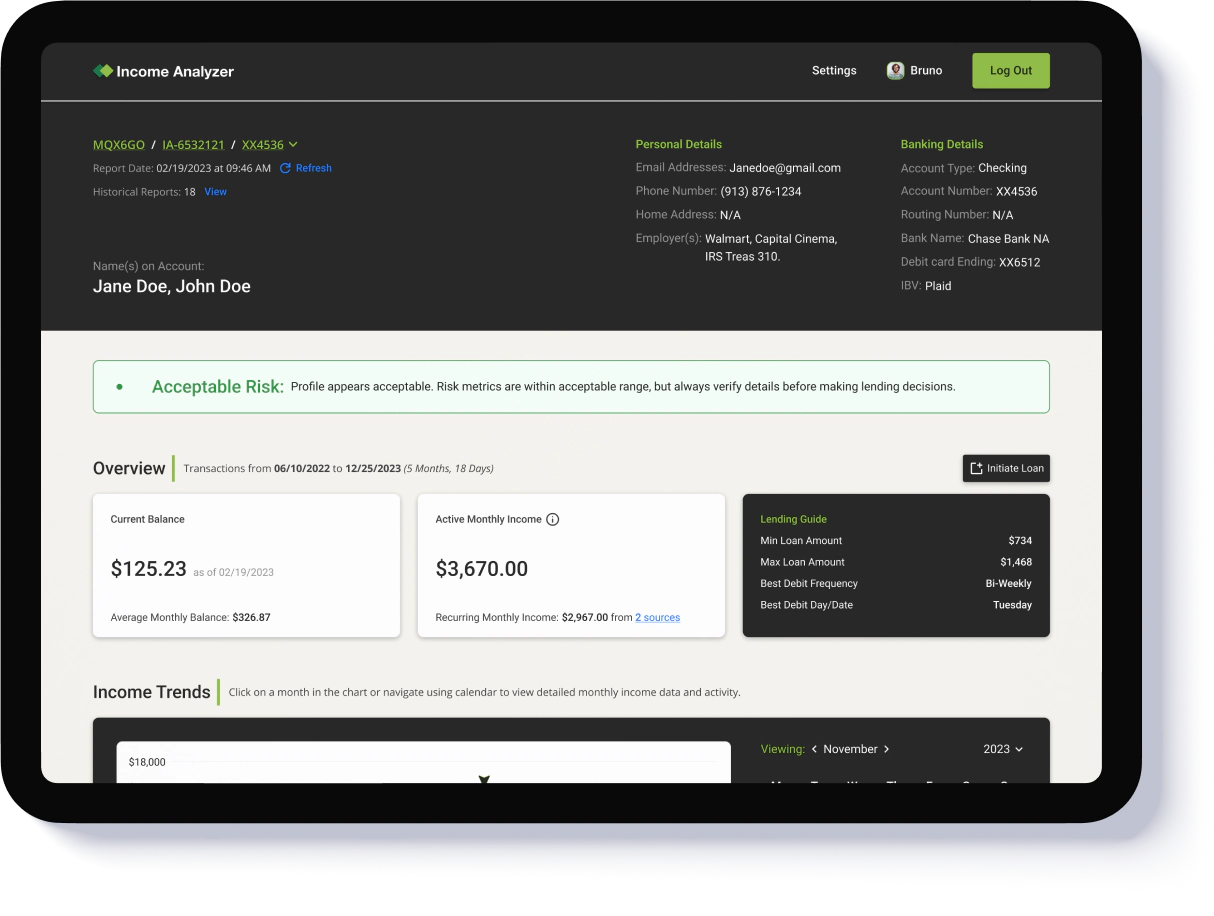

Built precise algorithms to detect income patterns and anomalies.

Ensured secure, compliant data handling with robust encryption.

Used SvelteFlow for real-time insights & seamless data workflows.

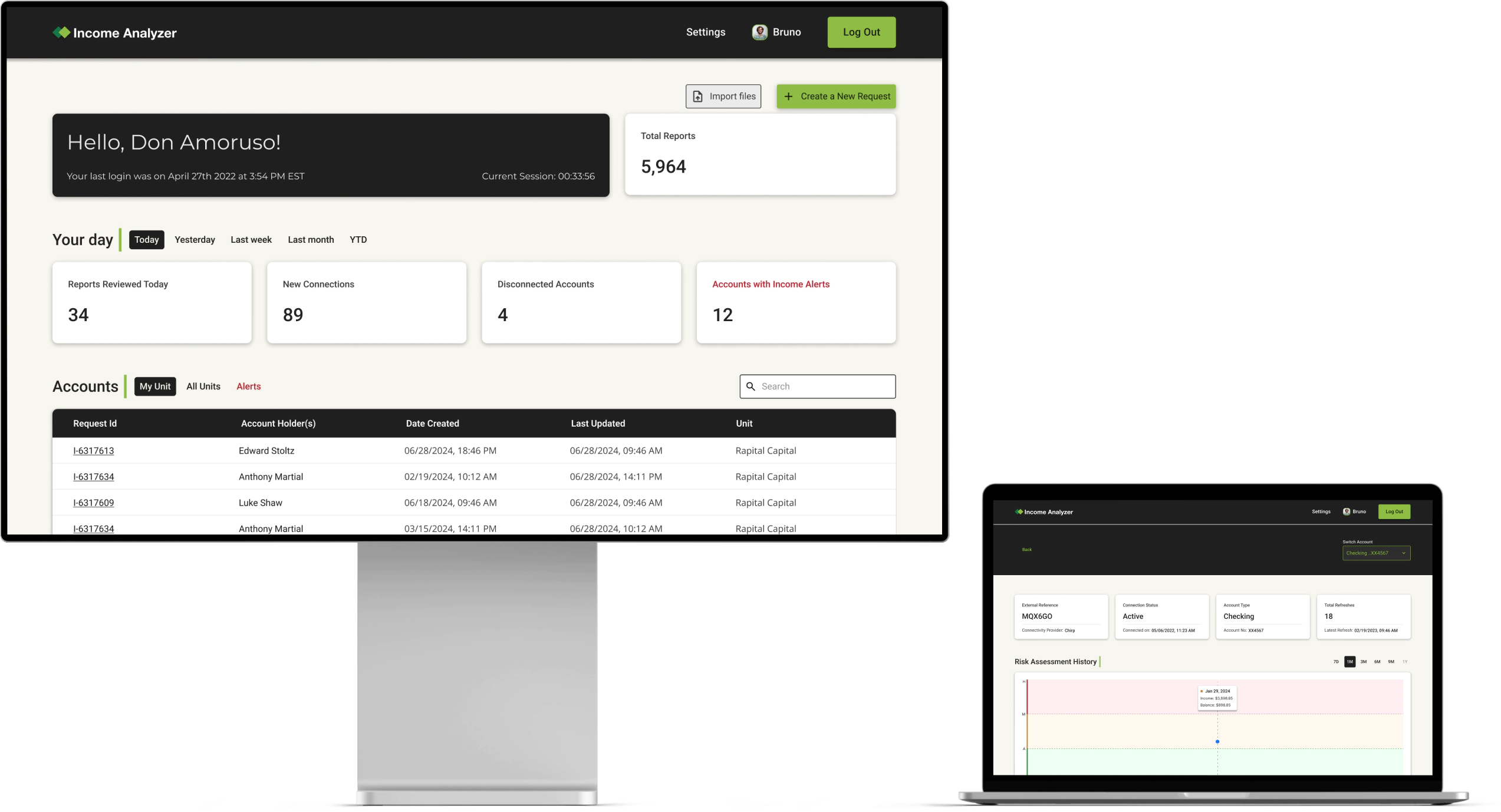

Designed clear dashboards to simplify complex income metrics.

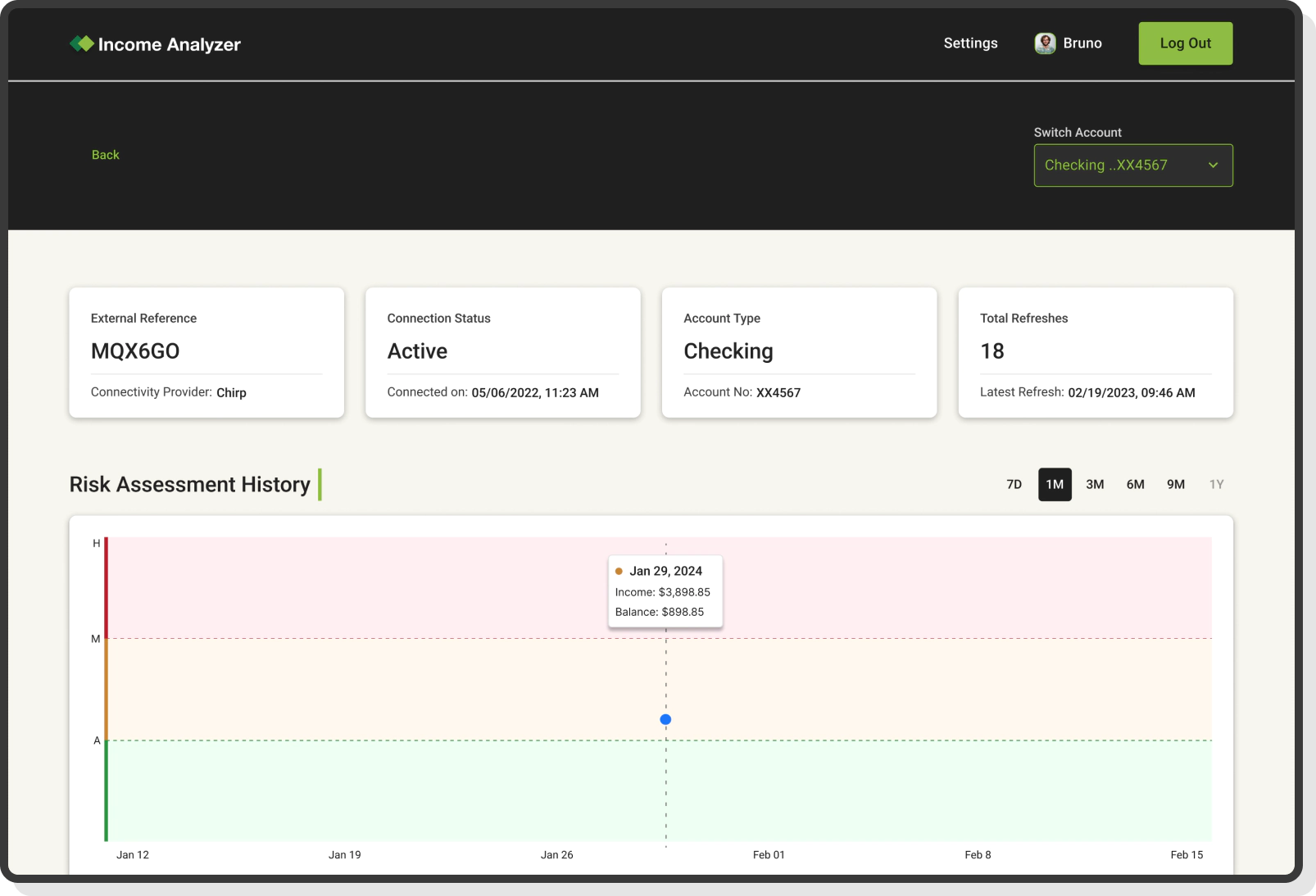

Engaging dashboard illustrating income trends, current balance, and other details, providing users with a dynamic way to interpret and analyze their financial data.

Improvement in Risk Assessment

Faster income verification process

Owner, DMA Associates LLC