In Part 1 of this knowledge series, we explored how artificial intelligence (AI) is revolutionizing financial services from foundational shifts in personalization and automation to new expectations around speed, inclusion, and trust. In this part, we will transition from theoretical concepts to practical applications by uncovering FinTech AI use cases, focusing on:

- How is AI being used today in FinTech?

- What challenges does it solve?

- And how is it making a measurable difference in lending, credit analysis, fraud detection, financial wellness, and beyond?

AI has evolved from a ‘nice-to-have’ tool to an essential strategic asset. These use cases highlight its ability to enhance operational efficiency, mitigate risk, drive inclusion, and build user-centric financial ecosystems.

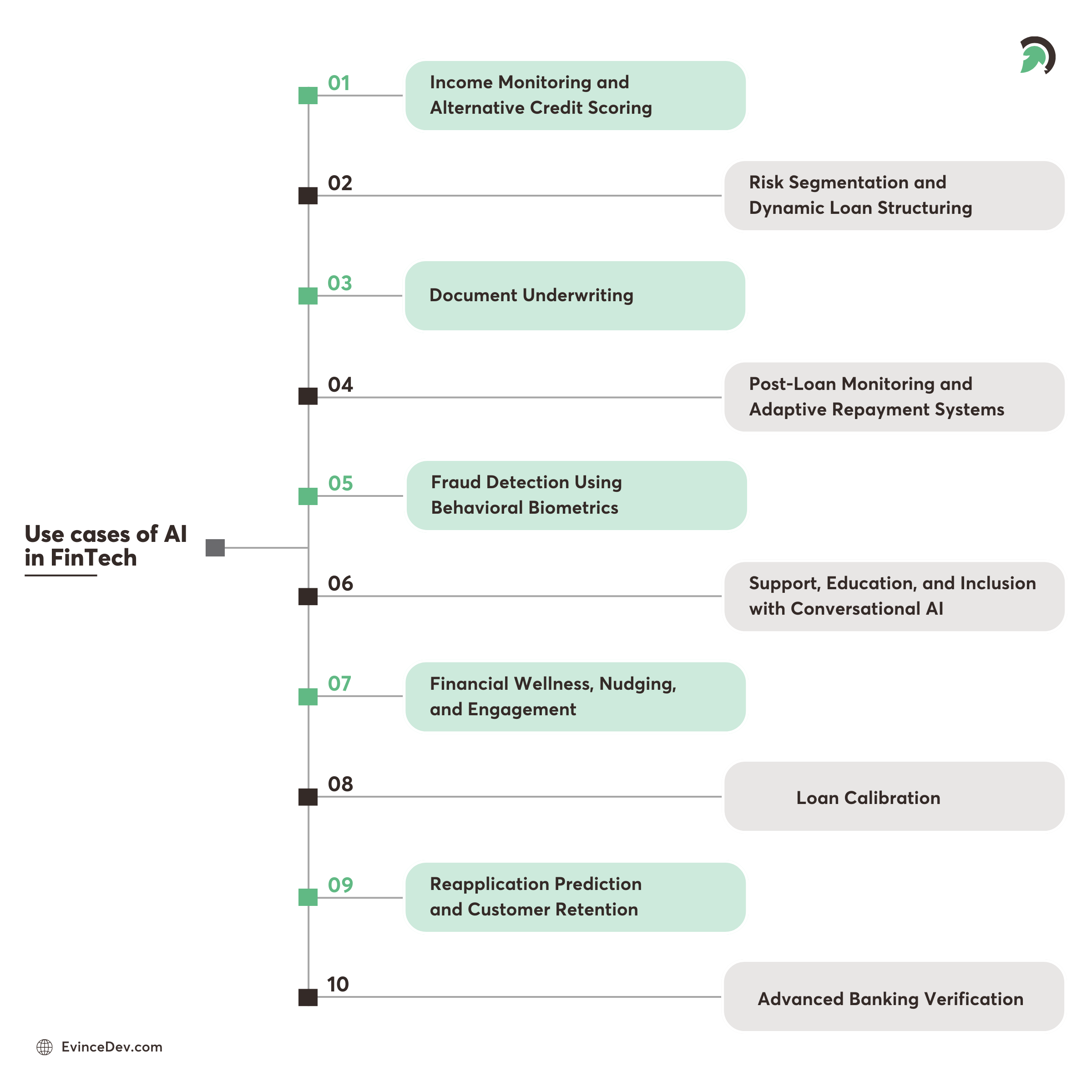

Top FinTech AI Use Cases with Examples

1. AI-Based Income Monitoring and Alternative Credit Scoring

Across the globe, millions of people remain excluded from formal credit systems, not because they lack reliability or are undeserving, but because conventional financial models fail to recognize and measure their true financial behavior.

Gig economy workers, immigrants, startup founders, freelancers, and small business owners often experience irregular income streams. Since their earnings don’t follow the predictable patterns favored by conventional scoring systems like FICO, they are frequently classified as risky borrowers.

With FinTech App Development, financial platforms can integrate AI to continuously assess real-time income, offering a more accurate and personalized approach to credit scoring.

That is, instead of relying on outdated credit scores, AI:

- Monitors real-time income flow

- Tracks how people earn, spend, and save

By integrating APIs from platforms like Plaid, Yodlee, or MX, AI-driven models can access live bank data (with consent), enabling them to assess true income stability, spending patterns, and financial habits in real-time.

Market Insight:

Apps like Brigit and Albert utilize this approach to provide personalized cash advances and budgeting assistance, enabling users to avoid costly overdraft fees and predatory payday loans.

How It Works:

Suppose a freelance graphic designer sees his income dip every summer. Traditional lenders would likely turn him away, assuming he’s an unreliable borrower.

But with Brigit in place, AI understands his seasonal income fluctuations and offers a tailored cash advance, helping him avoid payday loans and manage his cash flow more effectively.

It’s because:

- He pays his mobile bills on time

- His UPI transaction history shows steady income

- A psychometric test confirms his repayment discipline

Financial inclusion is not only an ethical imperative, but also a smart business strategy.

2. Risk Segmentation and Dynamic Loan Structuring

Traditional lending models rely on static risk assessments, which fail to adapt to borrowers’ evolving financial realities. For instance, a gig worker facing a sudden loss of contracts or an agricultural laborer experiencing seasonal income fluctuations may still be judged by their initial credit profile, leading to mismatched repayment terms.

However, AI in FinTech transforms this process by continuously analyzing real-time financial data, such as cash flow patterns, account activity, and spending categories, to enable segmentation that reflects real-time borrower behavior and dynamically adjust loan terms even after issuance.

Practical Applications in Action:

- Dynamic EMIs that scale with income fluctuations, helping borrowers stay on track

- Predictive alerts for both lenders and borrowers about potential missed payments

- Restructuring triggers that adjust loan terms based on risk shifts, enabling a sustainable repayment option

This way, instead of relying solely on outdated historical data, financial institutions can now act on live behavioral signals. This shift allows lenders to:

- Segment borrowers more accurately based on real-time behavior rather than historical snapshots.

- Offer flexible repayment options (e.g., temporary payment reductions) during financial stress.

- Prevent defaults proactively by detecting early warning signs (e.g., irregular income deposits).

Let’s understand this with an example.

Suppose a borrower takes out a personal loan during periods of stable income; months later, their earnings drop significantly. With a traditional lender using fixed repayment terms, this situation could result in missed payments and accumulating debt.

An AI-driven lender works differently. It detects irregular deposits and reduced spending, flags the account as temporarily high-risk, and automatically offers a reduced EMI for three months, with an option to extend.

Once income recovers, the repayment terms are readjusted, helping both the borrower and the lender.

This shift from static to dynamic lending reduces risk and makes credit more human-centric.

3. Loan Calibration

Traditional lending models tend to lose accuracy over time as borrower profiles, channel dynamics, and macroeconomic conditions evolve. Quarterly or ad‑hoc model reviews can’t keep pace. AI-driven recalibration ensures lending models and pricing stay aligned with current market and borrower realities on a daily basis, not just quarterly.

How It Works:

- Runs back-tests to detect model drift

- Adjusts score thresholds and policies dynamically

- Re-optimizes APR and fee curves to balance risk and returns

- Feeds servicing data (missed debits, income volatility) back into models

4. Document Underwriting Using AI/ML

Document-heavy processes, such as loan applications, account openings, and insurance claims, are often the silent bottlenecks in many businesses. These processes drag operations to a halt, creating backlogs that result in wasted time, unnecessary costs, and inefficiencies.

Additionally, they are vulnerable to human errors, including misplaced files, incorrect data entry, and missed signatures. Plus, these systems are susceptible to fraud, as paper documents can be easily altered or forged.

AI addresses these challenges and streamlines document management using:

- OCR technology to turn paper-based or image-based files into machine-readable, digital text that can be stored and analyzed

- NLP to extract meaningful data from unstructured text that businesses can act on

- Pattern recognition to flag inconsistencies or anomalies and ensure fraud doesn’t slip through unnoticed

Startups like Alloy and Ocrolus serve as prime examples of leveraging AI/ML in document underwriting.

Let’s break this down with an example:

Imagine a small business owner applying for a loan to expand her shop and submitting her loan application with various documents, including tax returns, financial statements, and an identification card. Since the bank relies on a traditional, document-heavy process, the loan officer must manually review and verify each document.

However, due to the high volume of loan applications, some of the shared papers get misplaced in the shuffle, which leads to delays and errors, causing the bank to take weeks longer than expected to process her loan.

However, if the bank uses a digital, automated system to process her application, the outcome would be different. Instead of waiting days or weeks for manual checks, her loan request could be reviewed in real-time. Advanced algorithms would verify her identity instantly and cross-check her financial details against secure databases. This would not only speed up approval but also ensure a higher level of security.

Quick Stat:

Ocrolus claims its AI tools can process financial documents with 99% accuracy in under 5 minutes.

In highly regulated sectors such as insurance or mortgage lending, this approach not only accelerates processes but also strengthens compliance, reduces operational costs, and enhances customer satisfaction by significantly shortening turnaround times.

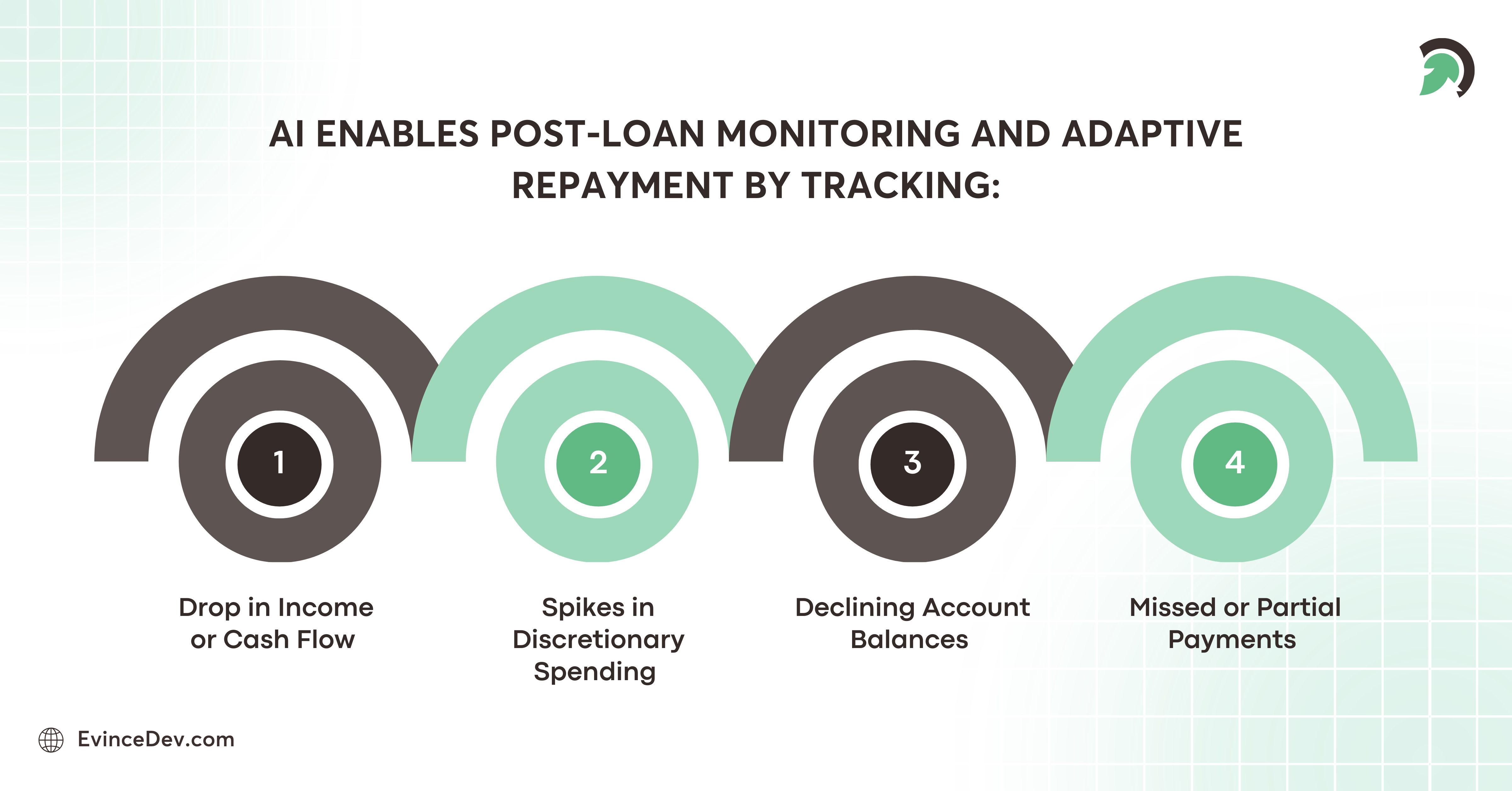

5. Post-Loan Monitoring and Adaptive Repayment Systems

Earlier, lenders operated with a “set-and-forget” approach, that is, once a loan was disbursed, they had little visibility into the borrower’s financial health until a payment was missed.

By that time, it was often too late to prevent default.

Today, AI can continuously monitor a borrower’s financial behavior, detecting signs of repayment stress and providing early warnings long before a default becomes inevitable.

AI can effortlessly track the following:

- Drop in income or cash flow

- Spike in discretionary spending

- Declining account balances

- Missed or partial payments

With this visibility, platforms can trigger:

- Proactive nudges like ‘your EMI is due in 3 days’

- Language-specific reminders like ‘SMS notifications in Hindi, German, or Spanish with culturally appropriate phrasing’

- Rescheduling options like ‘shifting the month’s due date by 7 days’

- Personalized hardship plans or temporary relief tailored to the borrower’s situation, like ‘short-term interest reduction’

Thus, AI in post-loan monitoring and adaptive repayment systems works as a win-win for lenders and borrowers as it protects lenders from defaults while giving borrowers the breathing room they need to stay on track.

Market Insights:

Moody’s offers an AI-driven loan monitoring solution that automates covenant tracking, detects potential risks early, and provides comprehensive portfolio visibility. This system enhances risk management by leveraging AI to effectively monitor loan performance.

6. Fraud Detection Using Behavioral Biometrics

With AI FinTech Solutions, fraud detection has become smarter, analyzing behavioral biometrics and transaction patterns that are unique to each user. However, sophisticated fraudsters can easily bypass these simplistic filters. If the system flags transactions based on location, they can easily use a VPN to change their location. If it’s a device mismatch, they can use a new device with the exact details.

This is where behavioral biometrics offers a breakthrough. It’s the science of measuring subtle patterns in how people interact with devices. It analyzes unique patterns, such as scrolling rhythms, screen pressure, keystroke dynamics, swipe speed, transaction timing, and contextual factors, that make each individual’s digital footprint distinctive.

In short, AI/ML models trained on these patterns can:

- Detect bots, emulators, and credential stuffing attacks

- Flag account takeover attempts

- Verify user identity passively, without friction

Let’s understand this with an example:

Suppose a designer from Mumbai regularly uses her bank’s mobile app. She has a consistent routine, like daytime logins, quick dashboard checks, and one or two payments to familiar accounts. She types fast, swipes lightly, and always holds her phone upright.

One evening, a fraudster attempts to log in with her stolen credentials. In a traditional system, the fraudster can use a VPN to mask his location and keep transfers small enough to avoid suspicion.

But behavioral biometrics with AI works differently; it observes:

- The typing rhythm is slower,

- The scrolling is less fluid, and

- The fraudster holds the phone in landscape mode, unlike the owner’s usual pattern.

AI instantly identifies the mismatch, flags the activity as suspicious, blocks the transfer, and sends a verification alert to prevent fraud before it occurs.

Quick Stat:

BioCatch reports that its behavioral biometric models reduce annual fraud losses by over $1.5 billion across its clients.

Unlike passwords or OTPs, behavioral patterns are continuous and harder to fake, making them one of the most powerful fraud deterrents in modern FinTech.

7. Conversational AI: Support, Education, and Inclusion

Chatbots have matured from reactive support tools to proactive financial companions. Powered by Natural Language Processing (NLP), today’s bots can:

-

Understand multilingual inputs

If a user switches between their local language and English, they can still be understood seamlessly.

-

Personalize responses based on user history

If a user repeatedly asks about balance after transactions, the bot may proactively suggest savings goals/plans.

-

Push contextual nudges based on spending trends

If the spending patterns indicate a rise in discretionary expenses, the bot can nudge the user to establish a strict budget for the month.

-

Provide financial literacy support to low-literacy populations

Bots can provide voice messages or easy-to-understand explanations to clarify interest rates, loan terms, and repayment schedules.

This practice is particularly crucial in regions with limited access to bank services. In India, Kenya, and Latin America, many FinTechs now deploy WhatsApp-based AI assistants to onboard users, explain loan terms, or conduct surveys, all in regional languages.

Quick Stat:

As per the source, WhatsApp Business API have both experienced significant FinTech adoption in 2023, supporting everything from UPI enrollment to micro-insurance queries.

These tools are key to closing the last-mile access gap in financial services.

8. Reapplication Prediction and Customer Retention

In traditional lending, a rejected application is often treated as the end of the customer journey. However, not every rejection means the applicant is unworthy; many return later after improving income stability, credit behavior, or documentation. AI-driven reapplication prediction helps lenders identify which rejected applicants are most likely to reapply, turning a “not now” into a future “yes.”

-

Learning from history

Trains on the records of applicants who were initially declined but reapplied successfully later

-

Pattern recognition

Spots key signals like income growth, repayment behavior, age, digital activity, and reason for initial rejection

-

Reapply likelihood scoring

Predicts if, when, and how a customer is likely to reapply.

-

Targeted retention strategies

Powers personalized follow‑ups, such as educational nudges, financial tools, or pre‑approval pathways

9. Advanced Banking Verification (AI-Powered Onboarding, KYC & AML)

Manual verification is slow, error-prone, and susceptible to sophisticated fraudsters. AI-driven verification accelerates onboarding while strengthening identity assurance, bank account checks, and compliance.

-

eKYC with computer vision

OCR extracts data from IDs; face match + liveness detection verifies the person behind the document.

-

Bank account verification

API connections confirm account ownership, salary deposits, and basic cash-flow signals.

-

Risk & fraud analytics

ML flags anomalies like mismatched metadata, device fingerprint risk, and repeat applicant patterns.

-

AML screening with NLP

Continuous checks against sanctions lists, PEPs, and adverse media, with explainable risk scoring.

-

Decision orchestration

Policy engines route low-risk users straight through and escalate edge cases for review.

Let’s understand this with an example:

A neobank experiences high drop-offs during the signup process due to manual document uploads and lengthy verification checks. With AI FinTech Solutions, the bank can streamline the onboarding process, speed up verification, and provide users with a frictionless signup experience. With the help of AI verification, users scan their ID and take a quick selfie; the system extracts relevant fields, runs face matching and liveness checks, verifies the linked bank account via API, and screens against watchlists. Low-risk applicants are approved in minutes; higher-risk ones are auto-routed for enhanced due diligence with an audit trail.

Practical Applications in Action:

- Instant identity and liveness checks for mobile onboarding

- One-tap bank account linking to confirm income/ownership

- Real-time sanctions/PEP/adverse-media screening

- Device, IP, and behavior signals to detect synthetic IDs and ATO attempts

- Tiered KYC (lightweight vs. enhanced) based on risk score

10. Financial Wellness, Nudging, and Engagement

Beyond core services like lending or payments, AI backed by ML is also helping users build healthier financial habits.

Apps like Rocket Money, Qapital, and Emma focus on financial wellness. They use AI to:

- Analyze historical spending and categorize expenses

- Send reminders for budget limits or savings goals

- Recommend cost-saving measures (e.g., cancel unused subscriptions)

- Automate micro-savings

Market Outlook:

A study published in the International Journal of Research Publication and Reviews found that 58% of students believed AI-powered finance apps improved their financial literacy. Additionally, 55% rated budgeting and expense tracking as the most beneficial features, while 35% valued automated savings.

How it works:

Imagine a photographer who earns an irregular income; some weeks she receives several large payments, while at other times she might go two weeks without a single payment. This makes budgeting and saving tough due to an unsteady paycheck schedule.

She downloads an AI-powered financial wellness app and experiences significant improvements:

- The app analyzes her past transactions and categorizes them, including rent, groceries, transportation, and subscriptions. With this clear breakdown, she realizes that she’s spending much more on subscriptions she rarely uses.

- In weeks when she earns less, the app adjusts her budget downward and notifies her when she’s nearing her dining-out limits.

- Whenever she receives a client payment, the app automatically transfers 5% into a savings account.

This kind of everyday engagement increases retention, builds trust, and ultimately improves financial literacy, making AI a silent yet consistent financial coach.

Final Thoughts: A Financial World That Thinks Ahead

Across all FinTech AI use cases, lending, onboarding, fraud detection, and financial wellness, AI is becoming the nervous system of modern FinTech platforms.

What makes AI powerful is not just its ability to automate tasks, but also its capacity to continuously learn, adapt, and improve. The most forward-looking financial platforms don’t treat AI as a product; they build their infrastructure, strategy, and customer experience around it.

In Part 3 of this series, we’ll explore:

- How to architect AI-first FinTech products

- Balancing innovation with regulation

- Explainability and model auditing

- Building cross-functional teams that include data scientists, compliance officers, and UX specialists.

- The future is intelligent, inclusive, and adaptive. Let’s build it right.

👉 Ready to continue the journey? Read Part 3 here: Building AI-Ready FinTech Products – Strategy, Pitfalls & Best Practices (Part III)

Disclaimer: The views shared in this article are based on personal experience and research. I am not responsible for any decisions or actions taken based on this content, and readers are encouraged to verify all information independently. If you believe any part of this content includes incorrect details or copyrighted material, please get in touch, and we will promptly review and update it as necessary.