Key Takeaways:

- Right App Model: Choose P2P, remittance, business payouts, or wallet based on users, regions, and goals early.

- KYC Ready Start: Build onboarding with identity checks and risk rules early to avoid rework and launch delays.

- MFA Biometrics: Protect accounts with MFA, biometrics, and session controls to reduce takeovers and fraud.

- Bank Card Links: Support bank and card funding with secure APIs, retries, and confirmations plus status alerts.

- Compliance Core: Plan KYC, AML, privacy, licensing, and reporting so audits and ongoing updates stay manageable.

- Track Key KPIs: Measure success rate, settlement time, fraud accuracy, CAC, LTV, and uptime to guide fixes.

- Security Layers: Use encryption, tokenization, monitoring, and access controls to protect funds and data.

Money transfer app development has become essential for businesses building secure and scalable global payment ecosystems. As cross-border digital transactions expand, users expect instant transfers, transparent fees, and robust data protection standards. Companies entering this space must combine technology excellence with regulatory discipline and customer-centric design, which is why disciplined fintech app development is critical from day one.

Global payments are no longer limited to banks and traditional remittance providers. Startups, FinTech innovators, and enterprises now compete to deliver faster, more affordable international transfers. This shift creates both opportunity and responsibility for product teams building modern FinTech solutions.

Modern users typically look for solutions that provide:

- Fast domestic and international transfers

- Low currency conversion costs

- Strong security and fraud prevention

- Clear transaction tracking and notifications

- Easy onboarding with minimal documentation friction

Understanding these expectations shapes the entire product architecture and compliance strategy. So, read this blog to gain a practical understanding of money transfer app development, from defining the right product model to implementing security, compliance, and global payment infrastructure.

Quick Stats:

According to the World Bank blogs, officially recorded remittances to low and middle-income countries were expected to reach USD 685 billion in 2024, highlighting the scale of cross-border money movement and the growing demand for secure, reliable transfer platforms.

Defining Your Money Transfer App Model

Before starting development, clarify the primary use case your platform will serve. Some applications focus purely on P2P payment app development for local transactions. Others prioritize building an international remittance app for cross-border families and workers.

Business-oriented platforms may target companies needing cross-border payment solutions for vendors and contractors. Each segment requires unique compliance workflows and liquidity planning.

Common product categories include:

- Peer-to-peer personal payment apps

- International remittance-focused platforms

- Business payout and payroll systems

- Hybrid digital wallet ecosystems

Selecting the right model ensures technical decisions align with long-term growth goals.

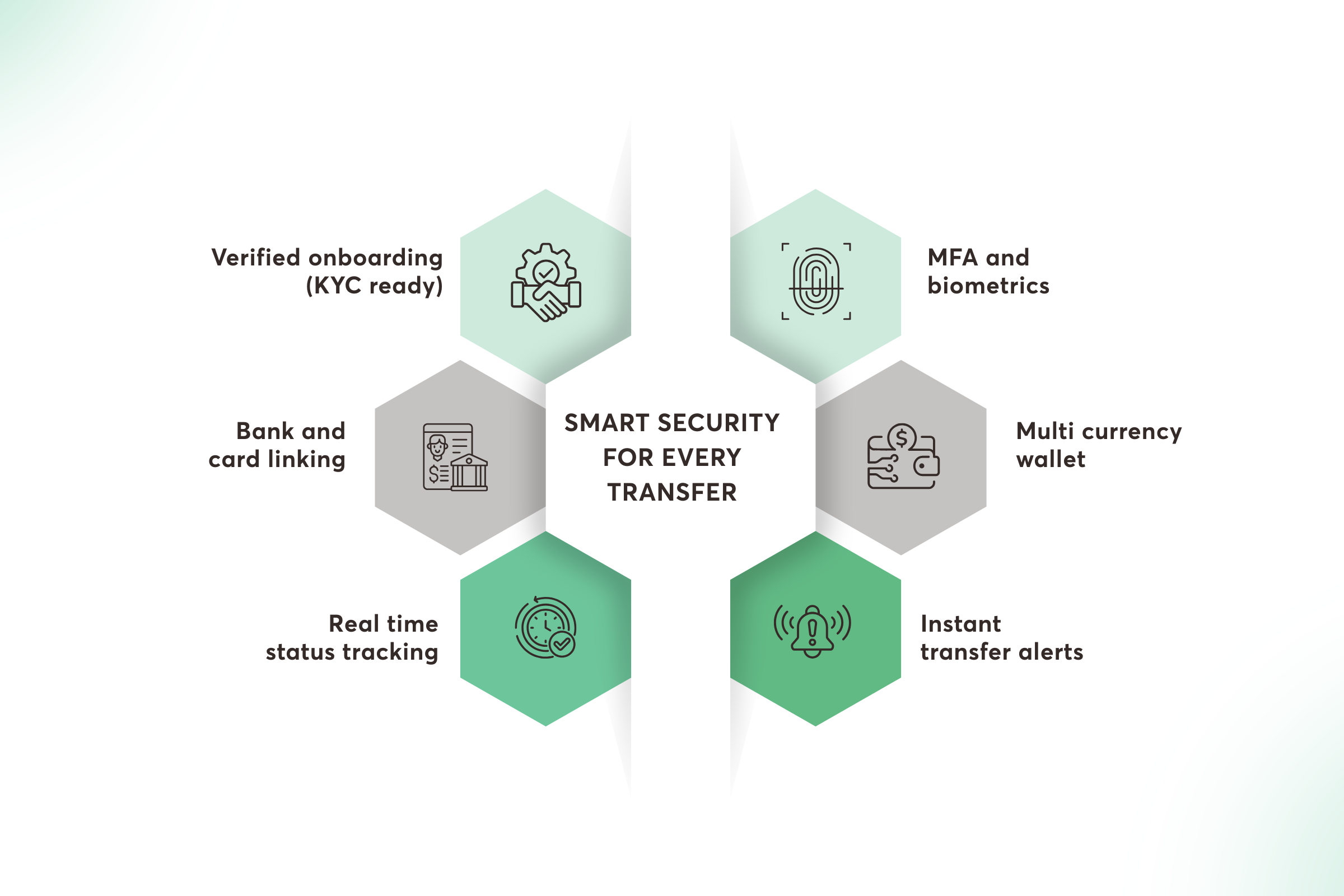

Core Features Required for Secure Transfers

Every successful platform begins with a strong functional foundation. Security, performance, and usability must operate together without compromise.

A modern money transfer application should include:

- Secure user registration with identity verification

- Multi-factor authentication and biometric login

- Bank account and card integration

- Multi-currency wallet support

- Real-time transfer status tracking

- Push notifications for completed transactions

These features support both FinTech payment software environments and consumer-grade applications.

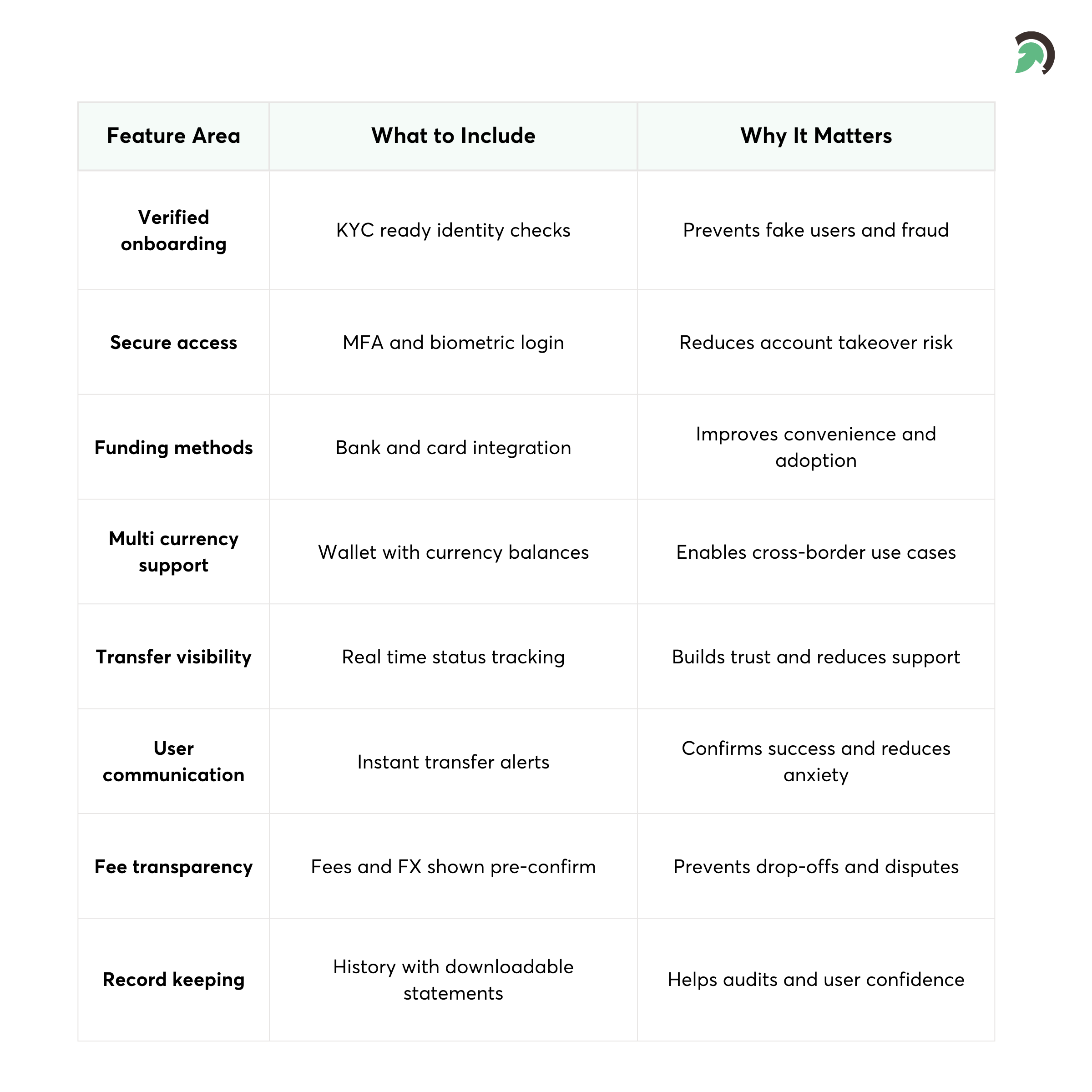

Beyond core transfers, advanced capabilities enhance competitiveness. Subscription payments, recurring transfers, and QR code transactions improve engagement. Integration with mobile banking app development ecosystems expands reach and user convenience.

Additional value-driven features may include:

- Transaction history with exportable statements

- In app dispute resolution workflows

- Transparent exchange rate calculations

- Fee breakdown before payment confirmation

When these capabilities work seamlessly, users develop long-term trust in the platform.

Secure Transfer Feature Checklist

Building a Secure Technical Architecture

Security must remain central throughout the money transfer app development lifecycle. Financial applications handle highly sensitive data and therefore demand layered protection strategies.

A strong security architecture should incorporate:

- End-to-end encryption for data in transit and at rest

- Tokenization of payment credentials

- Secure API gateways with strict authentication controls

- Continuous transaction monitoring systems

- Role-based access permissions for administrators

AI fraud detection FinTech solutions can further strengthen security by analyzing behavior patterns. These systems identify anomalies across devices, geolocation changes, and unusual transaction volumes.

Modern platforms are also adopting real time payments infrastructure to reduce settlement delays. Some innovators experiment with stablecoin transfers to lower cross-border transaction costs. Enterprises seeking operational efficiency explore instant settlement systems for faster reconciliation.

These technologies improve speed, but they must be implemented with careful auditing and fallback mechanisms.

Compliance and Regulatory Readiness

Compliance is not optional when building an international remittance app or payment platform. Regulations differ across regions and require constant monitoring and updates for regulated FinTech solutions.

Your compliance framework should address:

- Know Your Customer identity verification

- Anti-money laundering transaction screening

- Data protection and privacy regulations

- Financial licensing and reporting obligations

RegTech compliance automation tools help streamline documentation and reporting processes. Automated compliance systems reduce manual errors and improve audit transparency.

Ignoring regulatory obligations can result in fines, operational restrictions, and long-term reputational damage. Therefore, compliance planning must begin in the early stages of product design.

Technology Stack and Infrastructure Planning

Scalability and reliability depend on choosing a FinTech-grade technology stack. Money transfer platforms must handle high transaction volumes, low-latency processing, and consistent uptime while meeting security and compliance requirements.

Backend Infrastructure Requirements

A strong backend should support:

- Microservices-based architecture to separate critical modules such as onboarding, KYC, wallet, transfers, FX, notifications, and reporting, making scaling and updates easier.

- Cloud hosting with auto-scaling to handle traffic spikes and support multi-region deployment for better resilience and lower latency.

- High availability databases with replication, failover, and backup strategies to protect transaction records and ensure business continuity.

- Secure API integrations with banking partners, payment gateways, and compliance providers using encryption, authentication, rate limiting, and idempotency controls.

- Monitoring and alerting to track transaction success rates, latency, partner API failures, and unusual activity in real time.

Frontend Experience Planning

Frontend development should focus on clarity, trust, and minimal friction. A well-designed interface includes:

- Clear call-to-action buttons and guided transfer steps

- Simple currency selection with visible exchange rates

- Transparent fees shown before confirmation

- Smooth confirmation flows with biometric or OTP security

- Real-time transfer tracking with status updates and notifications

Balancing backend performance with a user-friendly interface improves adoption, reduces support issues, and builds long-term trust.

In regulated payment environments, fintech software development must prioritize auditability, security-by-design, and performance consistency across regions.

Cost Factors in Money Transfer App Development

The cost of developing a money transfer app development depends on the regulatory scope, infrastructure complexity, and integration requirements. Financial platforms require significantly higher investment than standard mobile applications due to compliance, security, and licensing obligations.

Primary cost drivers include:

- Financial licensing and regulatory approvals across target regions

- Integration with KYC and AML verification providers

- Payment gateway and banking partner integrations

- Cloud infrastructure and secure hosting environments

- Third-party security audits and penetration testing

- Ongoing compliance monitoring and reporting systems

- Dedicated fraud detection and risk management tools

Cross-border payment solutions typically require additional investment in liquidity management and foreign exchange partnerships. Operational costs also increase as transaction volume scales and regulatory oversight expands.

Instead of focusing only on initial development expenses, organizations should evaluate the total cost of ownership, including compliance updates, infrastructure maintenance, and customer support operations.

Build vs Buy vs White Label Strategy

Before committing to full-scale engineering, organizations must decide whether to build a money transfer platform from scratch, integrate via APIs, or adopt a white-label solution.

-

Build from scratch

Offers maximum control over architecture, compliance workflows, and product differentiation. This approach suits enterprises with long-term scalability goals and in-house FinTech expertise. However, it requires a higher upfront investment and a longer time-to-market.

-

API based integration with Banking as a Service providers

Allows companies to launch faster by leveraging existing payment infrastructure and regulatory coverage. This reduces licensing complexity but limits architectural flexibility and may affect profit margins.

-

White-label payment platforms

Provide rapid deployment and lower initial cost. While operationally efficient, white-label solutions restrict customization and long-term innovation potential.

The optimal approach depends on business model, regulatory appetite, funding capacity, and long-term strategic vision. Enterprises targeting global payment ecosystems often adopt hybrid models that combine proprietary development with licensed infrastructure components.

Third Party Integration Ecosystem

A modern money transfer application depends on a network of specialized third-party providers. Building every component internally is rarely efficient or compliant.

Key integration partners typically include:

- Identity verification and KYC providers

- AML transaction screening services

- Payment processors and acquiring banks

- Foreign exchange and liquidity providers

- Card networks and digital wallet gateways

- Fraud detection and risk intelligence platforms

Selecting reliable partners requires careful evaluation of API reliability, regional compliance coverage, service level agreements, and scalability. Poor integration planning can create transaction failures, settlement delays, and regulatory exposure.

Well-designed API orchestration ensures seamless coordination between these systems while maintaining performance and data security.

Key Metrics for Money Transfer Platforms

Successful money transfer platforms rely on measurable performance indicators to ensure financial sustainability and operational reliability. Monitoring the right metrics enables continuous optimization.

Critical KPIs include:

- Transaction success rate

- Average settlement time

- Fraud detection accuracy and false positive rate

- Customer acquisition cost

- Customer lifetime value

- Liquidity utilization efficiency

- Regulatory compliance incident rate

Operational metrics such as system uptime, transaction latency, and dispute resolution time also directly influence user trust.

By combining technical, financial, and compliance metrics, organizations can maintain balanced growth while protecting platform integrity.

Designing Cross-Border Payment Systems

Cross-border payment solutions introduce additional complexity beyond domestic transfers. In payment software development, currency exchange, settlement timing, and correspondent banking networks must be coordinated carefully.

Critical infrastructure components include:

- Multi-currency wallet management

- Real-time exchange rate integration

- Local payout partnerships in target markets

- Automated compliance checks for each jurisdiction

Optimizing foreign exchange margins helps maintain competitive pricing. At the same time, liquidity management ensures funds remain available for instant payouts.

Latency control and redundancy planning prevent service disruptions in global markets.

Quick Stat:

Cross-border payment solutions are expanding rapidly, increasing the need for scalable and compliant infrastructure. One industry estimate values the global cross-border payments market at USD 212.55 billion in 2024, and projects it to reach USD 320.73 billion by 2030, at a 7.1% CAGR from 2025 to 2030, according to a GrandViewResearch report.

Monetization and Revenue Models

Revenue strategy should align with the value users receive from the platform. Money transfer applications typically adopt transparent fee structures.

Common monetization models include:

- Flat transaction fees

- Percentage-based service charges

- Currency conversion spreads

- Premium subscription tiers for businesses

Enterprises building FinTech payment software often combine transaction fees with API licensing. Choosing the right model depends on the target market behavior and regulatory limitations.

Maintaining competitive pricing without sacrificing compliance investment remains critical for sustainability.

Development Roadmap from Concept to Launch

A structured roadmap reduces risk and accelerates time-to-market. Each stage must include technical validation and regulatory assessment.

- Market Research and Validation

Define target audiences and analyze competing payment platforms. Identify gaps in pricing, speed, or compliance transparency. - Product Design and Prototyping

Develop wireframes that simplify onboarding and transaction flows. Conduct usability testing before moving into full engineering development. - Minimum Viable Product Development

Build core transfer capabilities with integrated security and compliance layers. Avoid delaying encryption or identity verification. - Testing and Security Audits

Perform load testing under simulated high-volume scenarios. Conduct third-party penetration testing to validate security architecture. - Launch and Scaling Strategy

Start in a limited set of regions to manage licensing complexity. Expand gradually after validating operational stability and compliance readiness.

This phased approach ensures disciplined growth without compromising reliability.

Key Challenges and Risk Mitigation

Money transfer platforms operate in a high-risk environment where compliance, banking dependencies, and fraud threats can directly impact service continuity and user confidence. Proactive planning helps reduce disruption, protect margins, and maintain trust as transaction volume grows.

Common challenges include:

- Delays in regulatory approvals that can slow market entry and require product changes based on licensing conditions.

- Integration barriers with traditional banking systems, such as limited APIs, settlement cutoffs, and partner-specific operational constraints.

- Currency volatility and FX exposure which can affect pricing, profitability, and liquidity planning across corridors.

- Fraud attempts during early growth stages, including account takeovers, synthetic identities, chargebacks, and transaction laundering.

Strong governance frameworks, clear compliance ownership, and access to experienced FinTech advisors improve resilience. Continuous monitoring, fraud controls, and a defined incident response process help reduce operational exposure and support long-term platform stability.

Conclusion

Money transfer app development requires balancing security, compliance, performance, and user experience within one cohesive strategy. Building a reliable global payment platform requires a robust technical architecture, regulatory awareness, and disciplined execution from the earliest planning stages.

Organizations that invest in scalable infrastructure, proactive risk management, and transparent operational processes gain a sustainable competitive advantage. By combining thoughtful P2P payment app development practices with resilient cross-border payment solutions, businesses can deliver secure and efficient global transactions.

At EvinceDev, we help FinTech startups and enterprises build secure global payment platforms and end-to-end fintech software solutions with compliance-focused engineering and future-ready infrastructure.