AI in FinTech is no longer just a futuristic concept; it’s a transformative force reshaping the very foundation of the global financial system. From determining who qualifies for credit to revolutionizing fraud detection to empowering individuals with smarter ways to manage their savings and investments, AI is driving unprecedented change across every layer of financial services. In this blog, we’ll explore how AI/ML in FinTech is redefining banking, payments, lending, and wealth management, one innovation at a time.

“As the Founder and CEO of EvinceDev Inc. and Eatance Inc., and a member of the Forbes Technology Council, I have spent over two decades leading digital transformation across startups, banks, FinTech institutions, and enterprise platforms. Throughout this journey, I have spearheaded the creation of AI-powered ecosystems that serve both established financial institutions and next-generation digital lenders.

Over the years, I’ve seen outdated systems rapidly give way to intelligent, real-time technologies. Processes that once took weeks, like approving a loan or verifying an identity, can now be completed in seconds with AI tools. But this evolution goes far beyond speed and automation. It’s about fostering trust, expanding access to financial services, delivering truly personalized experiences, and creating adaptive systems that support every individual’s unique financial journey.”

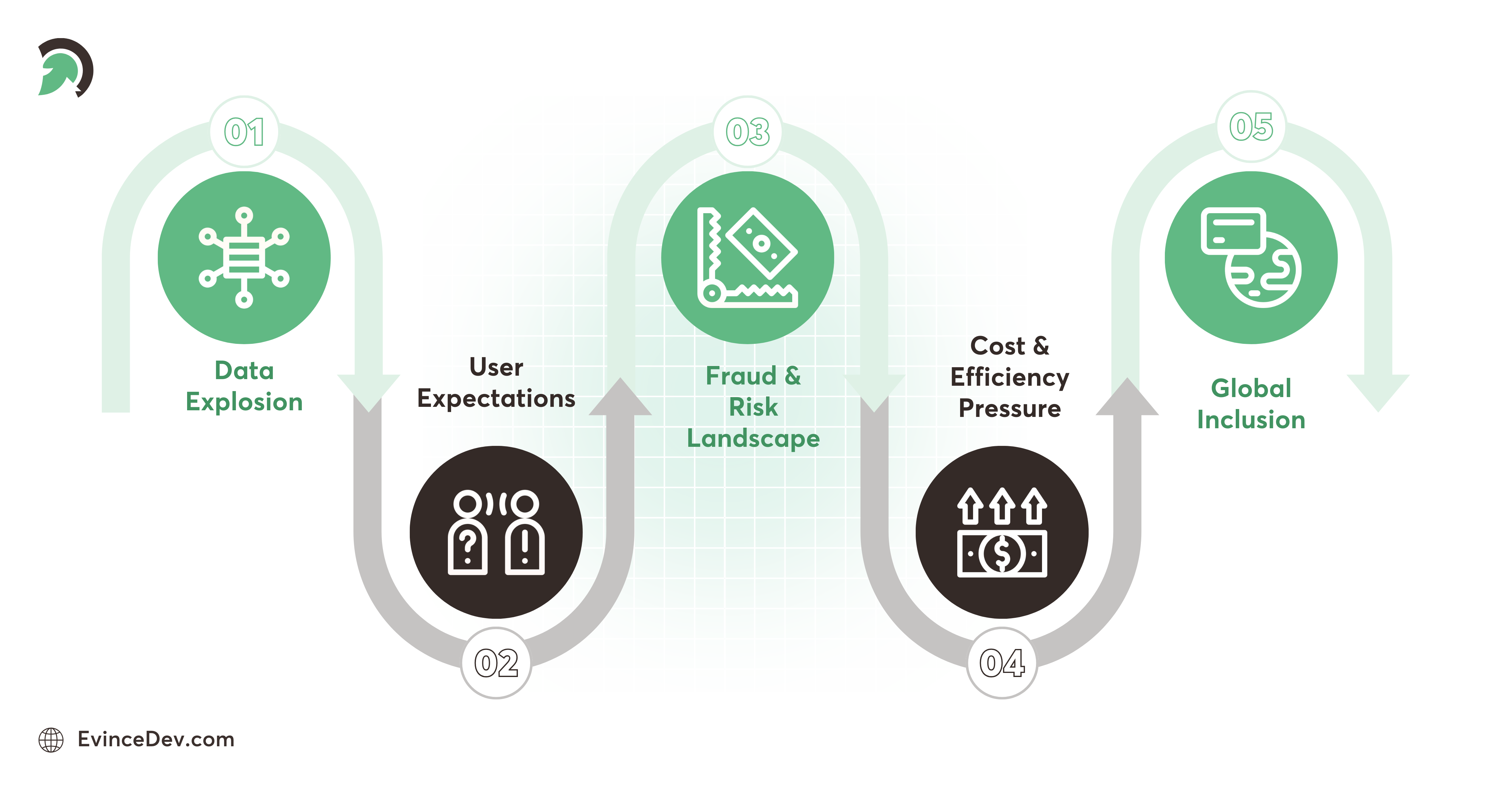

Why FinTech Needs AI Now More Than Ever?

Before diving into the how, we need to address the why. What’s driving AI’s meteoric rise in FinTech? The spark comes from the convergence of five powerful forces:

- Data Explosion: Every day, billions of transactions, clicks, and interactions generate a wealth of data. This constant stream becomes the lifeblood of AI models, enabling them to learn, anticipate, and refine financial decision-making.

- Consumer Expectations: Today’s users live in an on-demand world where patience is in short supply. The days of waiting for a loan officer or wrestling with paperwork are long gone. They expect instant approvals, hyper-personalized insights, and a frictionless, digital-first journey from start to finish.

- Fraud & Risk Landscape: Financial crime is getting more sophisticated, and AI in FinTech is essential for spotting patterns that humans can’t catch quickly enough. AI delivers real-time anomaly detection, flagging suspicious activities instantly to prevent potential financial threats.

- Cost & Efficiency Pressure: Operating leaner and smarter is essential for both startups and legacy banks, and AI makes it possible by taking over repetitive tasks with unmatched speed and precision.

- Global Inclusion: Millions are underbanked. AI leverages alternative data to assess creditworthiness and bring them into the financial system.

A report from McKinsey estimates that AI technologies could deliver over $1 trillion in annual value for global banking by improving productivity, compliance, customer satisfaction, and fraud detection. This makes the role of AI in banking and finance central to digital transformation efforts worldwide.

What’s Driving the Shift in FinTech: Three Core AI/ML Trends

The Rise of Alternative Data

Financial institutions have traditionally relied on a narrow set of metrics like credit scores, income verification, and banking history. Such traditional credit scoring excludes people with limited financial history. AI in the FinTech landscape changes this by tapping into alternative data like utility bills, rent payments, mobile recharges, geolocation data, and digital wallet activity.

This approach opens credit access for:

- Gig workers

- First-time borrowers

- Self-employed people

- Small merchants with limited financial records

Example: Imagine a shopkeeper who deals primarily in cash or UPI. With no credit history, he’s typically rejected for a loan. But AI can analyze his daily digital payments, business location stability, and phone usage to assess risk.

Quick Stat:

- Tala scans 10,000+ smartphone data points, including SMS history and geolocation

- Petal uses income streams and payment consistency to evaluate creditworthiness

- Startups leading the way: Tala, Petal, Branch

AI in FinTech for Cost Reduction & Operational Efficiency

Facing mounting pressure to lower costs without compromising service quality, the financial industry is pivoting to AI automation. For both FinTechs and traditional banks, it’s becoming the go-to solution in order to automate tasks like:

- KYC onboarding using facial recognition and OCR

- Loan processing via automated document review

- Fraud monitoring using machine learning to analyze billions of real-time data points

Quick Stat:

Neobanks like Chime and N26 operate with minimal human intervention, offering no-fee accounts by relying on AI to streamline their backend operations. Their rapid success has compelled larger banks to rethink their workflows and overhaul cost structures to stay competitive.

Hyper-Personalization Is the New Standard

Today’s consumers expect tailored advice, reminders, and nudges, and not just generic dashboards. Apps like Cleo, Digit, and Plum use conversational AI and behavioral data to:

- Alert users to overspending

- Suggest savings plans

- Recommend budgeting adjustments

By integrating collaborative filtering with reinforcement learning, AI evolves apps into intelligent, personalized financial coaching tools.

Quick Stat:

- Report reveals that Bank of America’s AI assistant, Erica, crossed 1.5 billion interactions by 2023, offering proactive insights like cash flow predictions and subscription flagging.

- Cleo uses wit and tone to drive savings behavior.

- Plum suggests automated micro-savings based on spending patterns.

This shift is no longer a mere advantage; it’s a critical driver of user retention and long-term satisfaction.

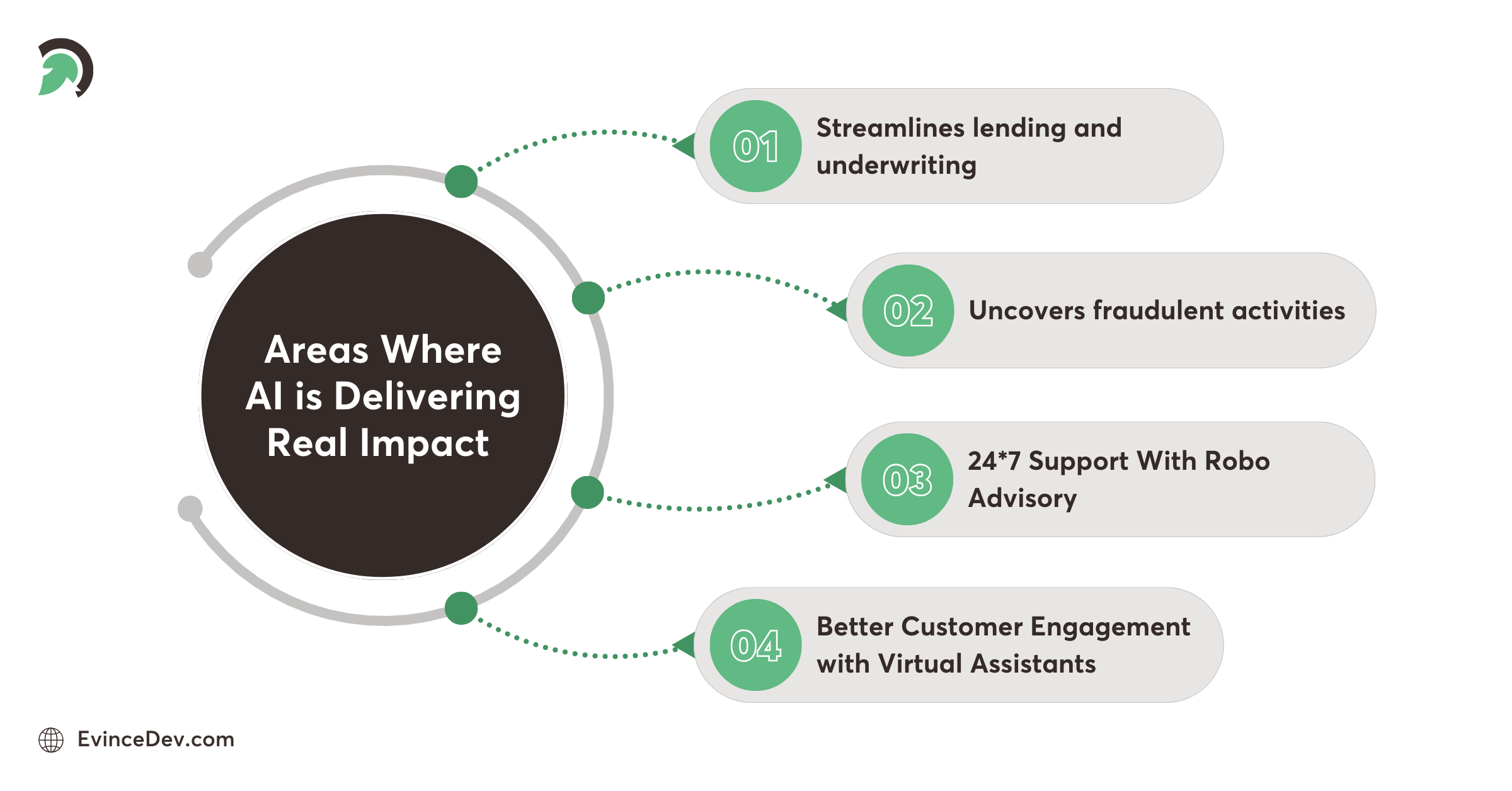

Key Areas Where AI in FinTech is Making a Real Impact

Across lending, fraud detection, wealth management, and compliance, AI in financial services is proving to be a catalyst for innovation and trust.

Lending and Underwriting

Traditional underwriting has long relied on static credit scores and historical repayment data. While effective in some cases, this approach often excludes first-time borrowers and thin-file customers who lack extensive financial histories. As a result, many qualified individuals are left without access to credit.

AI fundamentally changes this landscape by introducing dynamic, adaptive underwriting models. Unlike legacy systems, AI-driven platforms continuously adjust to real-time behavioral signals, employment trends, and digital footprints, enabling a far more accurate and inclusive credit assessment.

Innovators like Upstart are leading the way by leveraging over 1,600 non-traditional data points, including education, job stability, and spending behavior. These advanced models have proven to approve more deserving borrowers while reducing default risk, outperforming conventional credit scoring methods.

Quick Stat:

Upstart uses 1,600+ data points to approve 43% more borrowers while reducing defaults by 41%, according to its 2023 report.

Fraud Detection

As digital fraud gets more sophisticated, AI becomes the sentry wall for FinTech. With real-time behavioral analysis and anomaly detection, AI flags risks before damage occurs. AI detects behavioral anomalies, analyzes device metadata, and assigns real-time risk scores to prevent breaches.

Quick Stat:

Mastercard’s Decision Intelligence flags anomalies in under 50 milliseconds across 75 billion transactions annually.

AI models powered by ML also improve over time through continuous learning. Tools like Feedzai and Darktrace adapt to new threats using behavioral analytics and network graph analysis, strengthening defenses as fraudsters evolve.

Wealth Management & Robo-Advisory

Gone are the days when only the wealthy had access to financial advice. AI democratizes wealth management by:

- Automating investments

- Creating risk-adjusted portfolios

- Offering tax-loss harvesting and financial planning

Platforms like Betterment, Ellevest, and Wealthfront use user data and preferences to personalize long-term investment strategies. Many of these platforms also integrate AI-driven tax optimization, automatically selling investments at a loss to offset gains known as tax-loss harvesting. (NerdWallet)

Robo-advisors typically ask users a series of onboarding questions to assess their financial goals, income, dependents, and risk appetite. AI backed by ML then designs personalized plans and adjusts them based on market fluctuations.

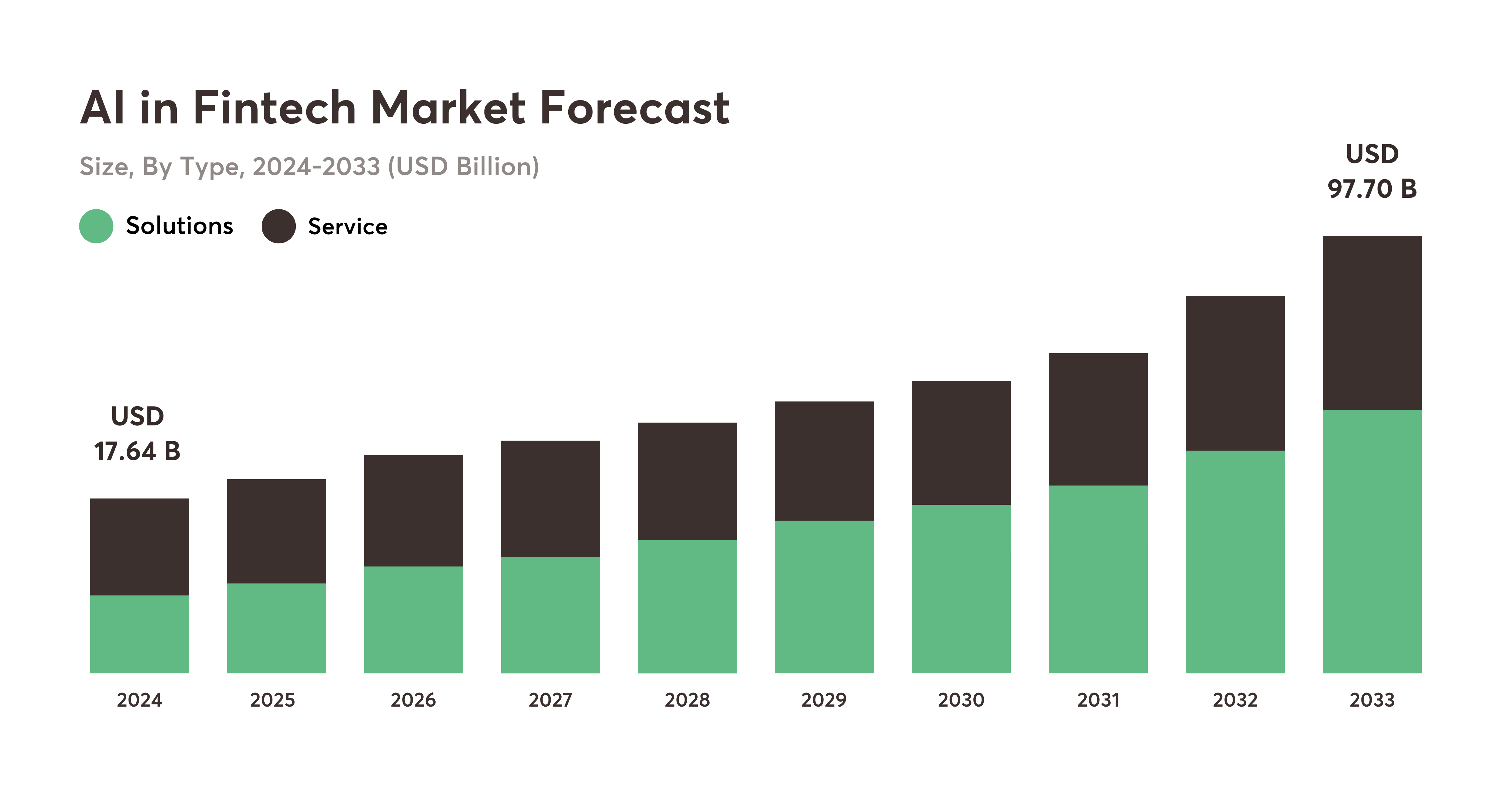

Market Outlook:

According to a report from Fortune Business Insights, the global robo advisory market size was valued at USD 8.39 billion in 2024. The market is projected to grow from USD 10.86 billion in 2025 to USD 69.32 billion by 2032, exhibiting a CAGR of 30.3% during the forecast period.

Conversational AI & Customer Engagement

Chatbots are more than support; they’re smart financial advisors. Conversational AI tools act as financial copilots, blending NLP, sentiment analysis, and predictive analytics to deliver contextual, real-time advice.

Using NLP, these bots:

- Handle account queries

- Recommend new products

- Offer personalized financial coaching

Examples:

- Cleo offers financial tips with humor, making budgeting less intimidating

- Plum suggests how much to save based on your weekly spending

- Digit transfers small amounts to your savings based on your behavior

Conversational AI is particularly impactful in emerging markets where user literacy may vary. A well-designed chatbot can educate, guide, and simplify financial journeys.

Regulatory Compliance and Anti-Money Laundering

Regulatory compliance is time-consuming and resource-intensive. AI simplifies this with:

- Automated transaction monitoring

- Suspicious activity flagging

- AML (Anti-Money Laundering) rule enforcement

Natural language understanding helps AI scan documents and flag non-compliant contracts or reports. Additionally, AI can assist in generating audit trails, filing regulatory reports, and improving transparency.

AI ensures that adherence to laws doesn’t slow innovation.

Integration: The Elephant in the Room

As FinTech companies grow, they increasingly depend on external APIs for bank data, credit reports, and payment processing. Platforms like Plaid, Yodlee, Sofi, and Chirp deliver essential integrations, but not without their challenges.

- Financial data often arrives in multiple formats.

- Inconsistent metadata further complicates integration.

- Maintaining real-time synchronization remains one of the toughest hurdles.

This leads to silos, forcing engineers to build complex mapping layers while slowing down product development.

At EvinceDev, we’ve solved this using vector databases like Pinecone. These systems allow semantic indexing, meaning data is understood in context, not just format, enabling unified, real-time user profiles across messy data sources.

More on this here: Pinecone’s Official Guide

The AI/ML Stack: What’s Under the Hood?

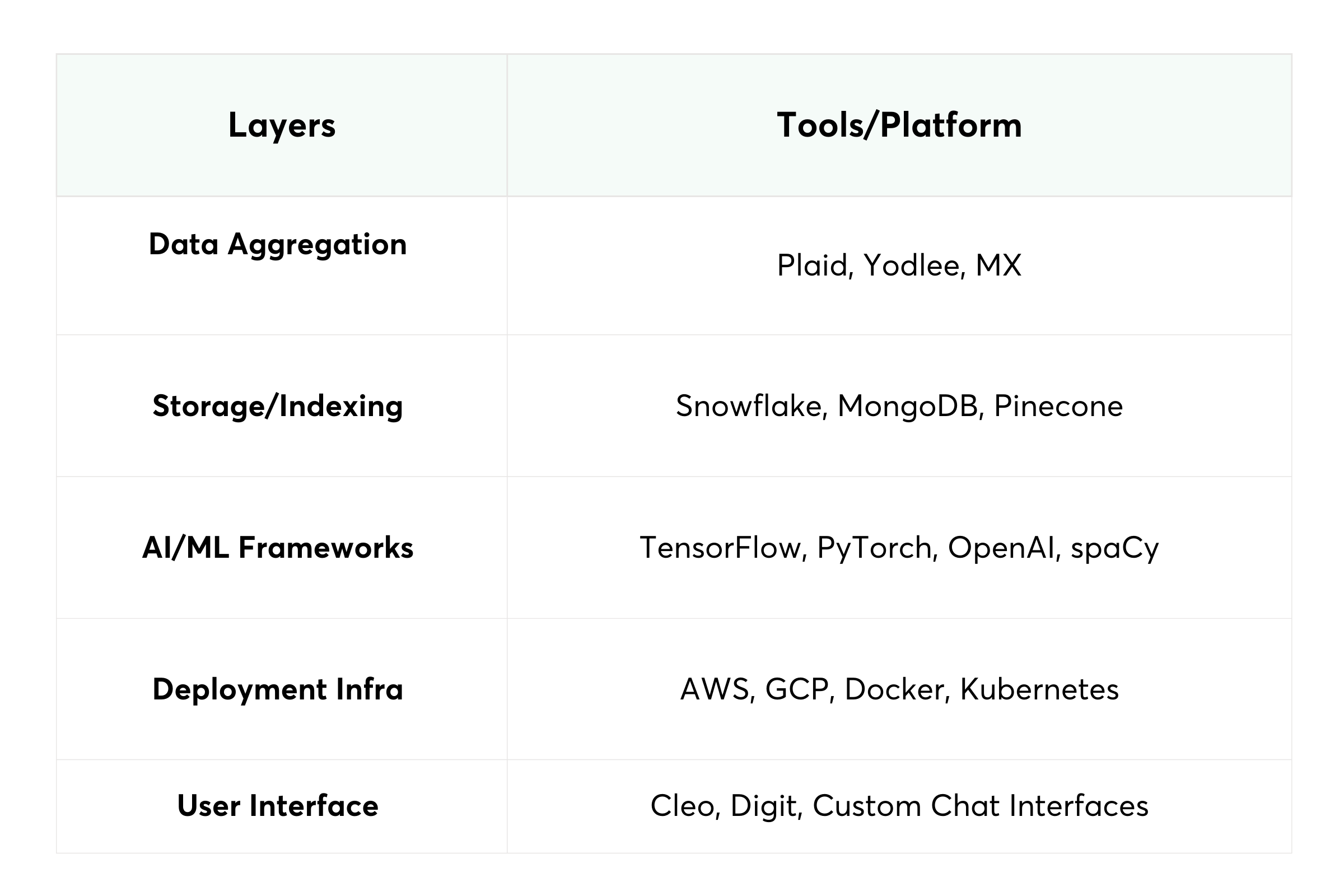

Behind every smart FinTech app is a complex ecosystem of tools. Here’s a simplified view of the AI-powered tech stack:

The choice of tech stack depends on scale, use case, and data needs. Many firms now turn to specialized FinTech software development services to implement AI-first architectures effectively. The principle remains: don’t add AI as an afterthought, build around it.

Ethical Considerations in AI-Powered Finance

With great power comes great responsibility. As AI becomes more pervasive in FinTech, ethical concerns must be addressed:

- Bias in algorithms: If training data is biased, AI in FinTech will replicate and amplify that bias.

- Privacy: AI systems rely on data. FinTechs must ensure user data is encrypted, anonymized, and used ethically.

- Transparency: Users and regulators should understand how AI decisions are made.

- Job displacement: Automation may reduce some human roles; the industry must invest in retraining and upskilling.

To stay ahead, companies should build internal AI ethics boards and follow global frameworks like the EU AI Act or OECD AI Principles.

Regulatory Landscape: Evolving Yet Essential

Regulators are catching up to AI’s rapid advancement. Key regulatory trends include:

- Data arrives in various formats

- Metadata is inconsistent

- Real-time sync is difficult

Collaboration between FinTechs, regulators, and AI experts is critical to fostering innovation while protecting users.

Final Thoughts: AI-Powered Financial Future

AI in FinTech market is not just about efficiency; it’s about inclusion, intelligence, and innovation.

It’s enabling:

- Faster lending

- Better fraud prevention

- Smarter savings

- Broader financial access

Whether you’re a startup founder, enterprise CTO, investor, or policymaker, AI in FinTech is no longer optional. From digital banking to FinTech app development, it has become the new foundation.

By adopting ethical, explainable, and user-first AI solutions, FinTechs can lead a financial revolution that’s smart, fair, and accessible to all.

In the next part of this series, we’ll examine case studies of how real companies are using AI to automate compliance, prevent fraud, and increase financial inclusion. We’ll also look at regulatory challenges and ethical frameworks shaping the AI revolution in finance.

👉 Ready to continue? Read Part 2 here: AI in Action: Real-World FinTech AI Use Cases Revolutionizing the Future (Part II)

Disclaimer: The views shared in this article are based on personal experience and research. I am not responsible for any decisions or actions taken based on this content, and readers are encouraged to verify all information independently. If you believe any part of this content includes incorrect details or copyrighted material, please get in touch, and we will promptly review and update it as necessary.