Running late to be somewhere, then listen to our Blog’s Podcast

Introduction to the Logistics Industry Growth

What do the following have in common – a pupil going to school on a bus, a citizen heading to offer a prayer, a person pedaling away to work – any guesses? The common thing is that everyone travels. Point A to Point B. This means using some form of transport. In a broader sense, a bus, bicycle, etc. are all the transport industry solutions.

One thing is sure, transport is ingrained so deeply in our lives that its importance is overshadowed. What also goes unnoticed is the neatly-stocked product shelves on our frequent visits to a supermarket – suggesting how Logistics & Supply Chain are critical to our daily lives and how the logistics industry growth has shaped us today.

For all those who have missed out on the First Blog of our ‘Transport & Logistics’ series, Please Read OR Listen to the Blog Titled: Will Growth In Transport Business Hit $12,256 Billion Mark by 2022?

| “Quality means the customer comes back, not the goods”, – Hermann Tietz, founder of Hertie. |

We all are familiar with the phrase – “Beauty is nothing without brains.” Transport and Logistics are interconnected similarly and share the same bond. While transport remains the beauty receiving all the face-value credits, logistics is the brain working behind the scenes to get everyone they need. Without waiting for further ado, let’s dig deep into the mind of the Logistics Industry Growth.

According to you, which of the following technology trends will transform the way ‘Transport & Logistics’ business is conducted? (Find out the answer in Part-III blog of the series)

[choices values='{“items”:”Blockchain via security,RPA via increasing efficiency & cost-cutting,IoT via end-to-end supply chain performance,AI via process automation”}’]

Overview, History & Importance of Logistics

The merger of the two worlds viz, ‘Logic’ and ‘Static’ formed the word Logistics that we use today. The word logistics implies you to effectively plan and maintain all kinds of products, services, and information flow in the supply chain from the start to the end-point. Majorly, it also requires you to arrange transport, storage, and control.

Traditional Transport and Logistics Systems concentrate on the Logistics Life Cycle from order to delivery in the shortest time with the least cost. Today’s Transport Logistics automation has made customers more aware, demanding, and connected. They want real-time information on location and delivery times. Competition and the Logistics Trends have left the doors open to work upon new approaches for old problems. New entrants in the Global Logistics Market have made the industry focus more on clients’ needs, adapting to new tech stack while also working on sustainability solutions.

Global Logistics Market

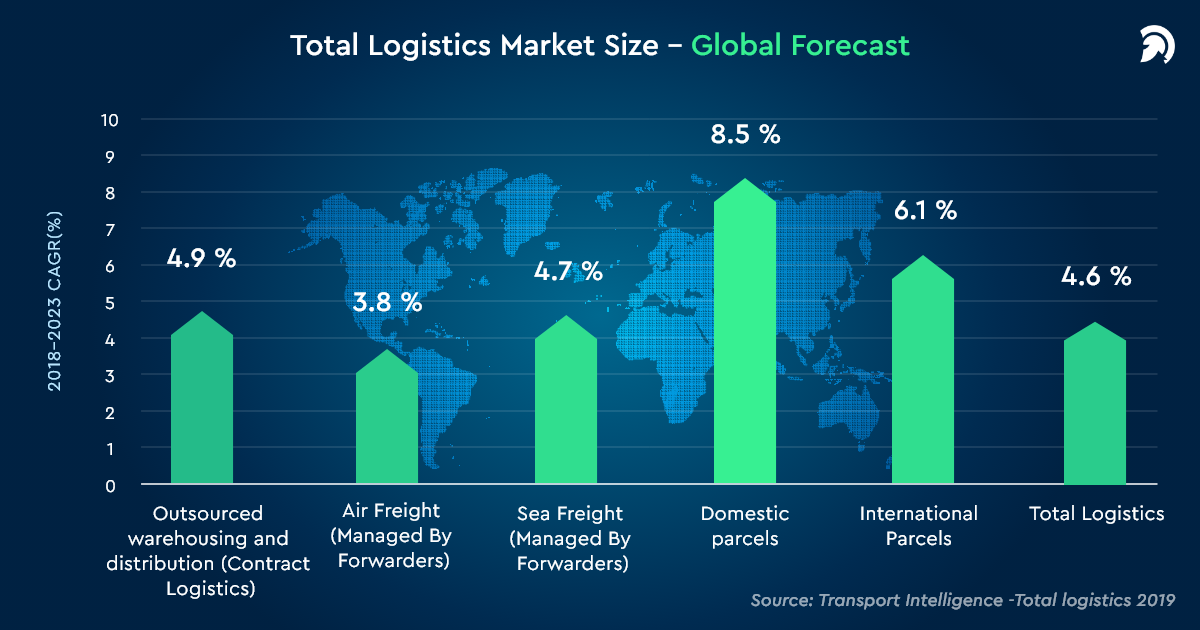

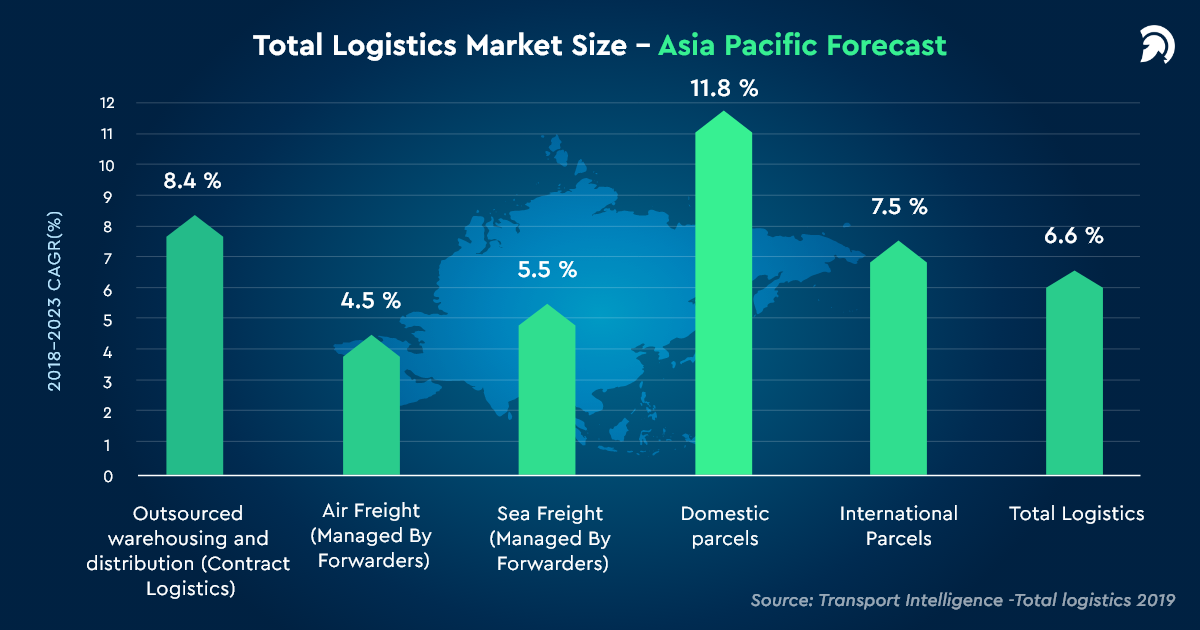

The total Global Logistics market size in 2018 accounted for €5.6 trillion, and it is expected to grow at a 4.6% CAGR for the period 2018-2023. If all things remain equal such as holding price and exchange rate, the global logistics industry growth will reap out €7 trillion by 2023. As per the graph, the total logistics for the Asia-pacific region has marked €2.4 trillion, roughly accounting for 45% of the Global Logistics spend.

The U.S & Europe markets (standing at €1.4 & €0.9 trillion respectively) show less spending on logistics premium. That is due to relatively better infrastructure, efficient system in-place, organized integrated service providers, and many other factors contributing to the Global Logistics Market.

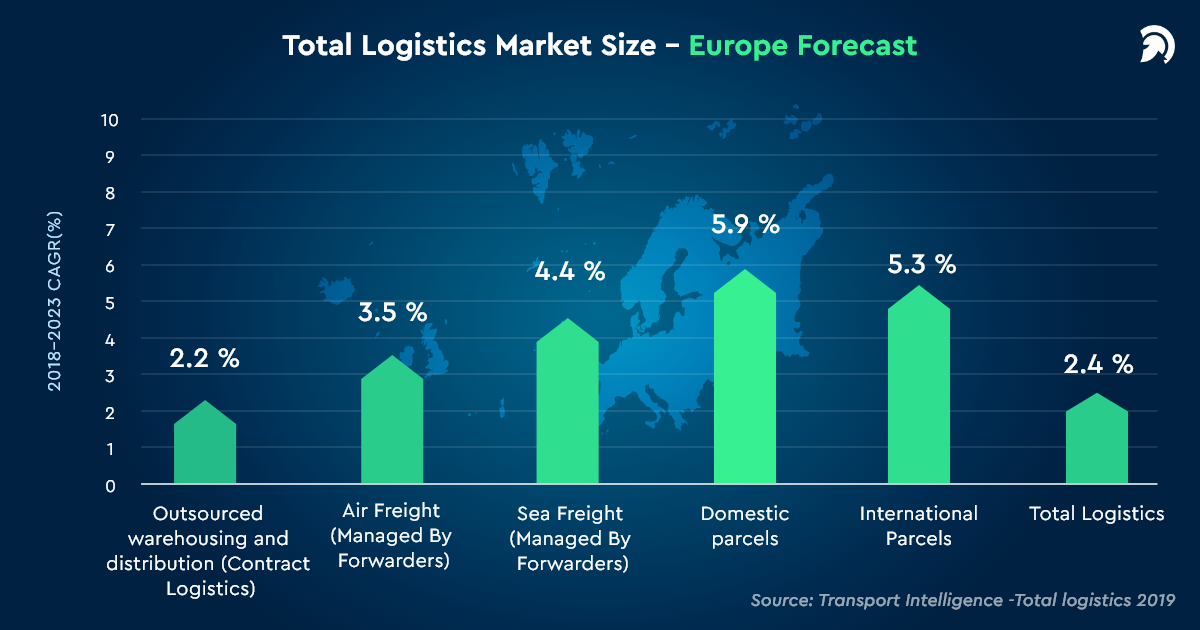

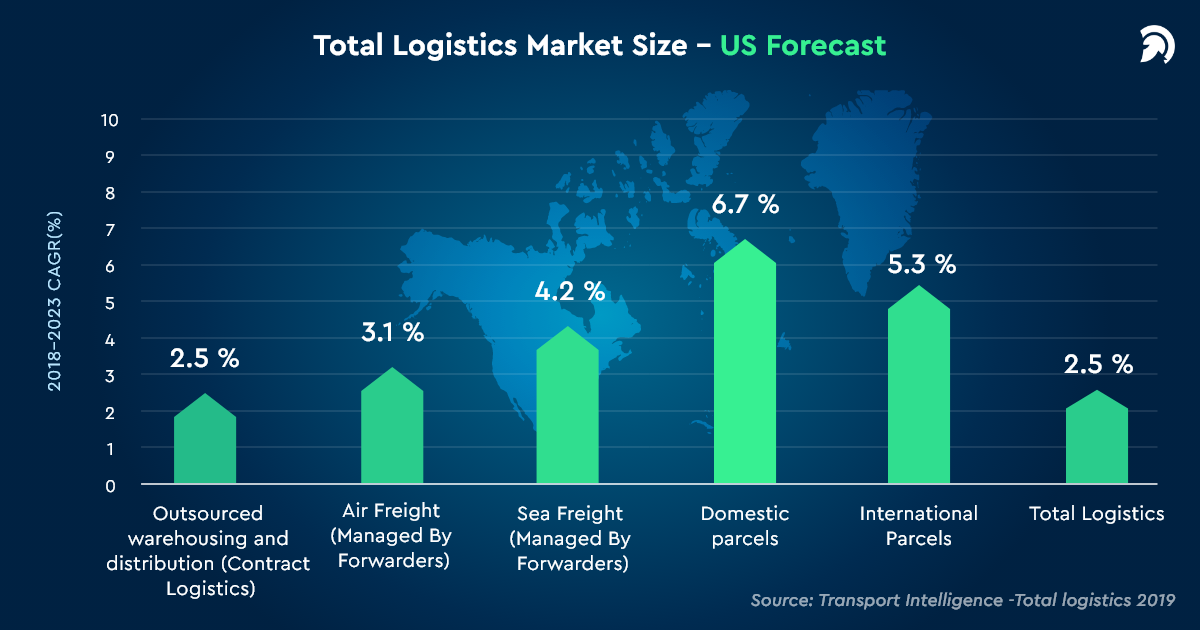

Let us have a quick view of the total share of the global logistics market forecast for said regions in the graphs below. The below forecast is derived based on various logistics channels and market segments such as outsourced warehousing, air freight, sea freight, domestic, and international parcels.

The study makes it quite clear that road freight (Less than truckload & Full truckload) almost captured one-third of the global logistics spend, i.e., €1,810 bn. Whereas, the second-largest segment, i.e., in-house and outsourced contract [majorly third-party (3PL) and fourth-party (4PL) logistics provider], came at €1,702 bn. Together they both contributed almost 60% to the growth of the Logistics Industry.

The fair share of the global logistics industry growth is also due to domestic & international parcel services, road, air, and sea freight sectors. Out of which, the global parcel market and road freight are potentially valued at €321 and €210 billion, respectively.

Key Takeaway Points For Asia-Pacific Region

- Developed markets such as South Korea, Singapore & Japan are going to contribute less.

- Emerging markets are rapidly transitioning towards e-commerce logistics.

- The trade war between China and the US could impact the economic slowdown.

- Manufacturers to drive their logistics operation from the south-east Asia region.

Key Takeaway Points For Europe Region

- Domestic parcel growth is relatively going to prove a stronger segment.

- European road freight is going to grow in single-digit, just like the 3PL & 4PL.

- Brexit has left the gap wide open for Europe’s supply chains, making it hard to forecast for the short term.

Key Takeaway Points For The U.S. Region

- Intra-regional volumes will be promising due to the United States-Mexico-Canada Agreement trade deal [USMCA replaces the North American Free Trade Agreement (NAFTA) formed in 1994].

- Amazon and other key players have structurally boosted domestic parcel growth with a shift towards e-commerce.

- Trade volume growth will up the tempo of air and sea freight sectors as per the US logistics market report.

Global Transport Logistics

The worldwide increase in trade has resulted due to the removal of cross-border movement within the trading blocks. These trading blocks are – the Asia-Pacific Economic Cooperation (APEC), the European Union (EU), and the North American Free Trade Agreement (NAFTA) now the United States-Mexico-Canada Agreement (USMCA).

The development of the trade network and advanced technology gave rise to a large number of trends in logistics and supply chain. It also allowed enhancing the efficiency of businesses across widely spread geographical locations.

Logistics Trends

- Restructuring of Logistical Systems.

- Realignment of Supply Chains.

- Rescheduling of product flow.

- Refinement of transport and warehousing management.

- Changes in product design.

- Integration of logistics

Evolution of the Global Logistics Industry

Startups and SMBs have disrupted the conventional logistics methodology with the new cutting-edge business models & logistics focused technology products and services. There is a huge growth opportunity in the logistics business, with the supply chain becoming smarter, quicker, and more customer-centric as well as sustainable. Consumers have more buying power with e-commerce logistics fuelling demand for transparency, affordability, convenience & speedy delivery of the goods as well as seamless reverse logistics.

Check the following points in a brief, which will summarize the evolution of the current global logistics market:

- Omni-channel logistics, inventory visibility solutions, and last-mile delivery solutions to enhance customer experience anywhere, anytime.

- Recent logistics trends also include innovations in packaging, transport & delivery.

- Dial it down as per customer lifestyles by providing door-to-door delivery.

- Green energy logistics (Green fleets) is going to be the new trend-setter in logistics trends.

- All-new packaging style & smart-containerization can pump-up efficiency in transport and reduce carbon emission.

- Internet of Things (IoT) in the connected logistics will deliver a smarter supply chain capabilities

- Artificial Intelligence (AI) to pave the way for predicting global trade and help in back-office automation by combining AI with RPA (robotic process automation).

- Distributed ledger technologies (DLT) such as Blockchain will bring simplicity by removing complicated process layers and help in redefining old processes.

Supply Chain Management

It connects suppliers, manufacturers, warehouses, logistics, distributors, and end customers. They are connected in the form of an integrated collection of skills and resources aimed at delivering service and products to customers.

The supply chain is usually associated with cost and revenues involved in each component:

- Costs with Suppliers/Raw Material.

- Transport Costs.

- Costs of Production.

- Storage & Distribution Costs.

- Revenue From Customers.

This drives the need for SCM (Supply Chain Management) applications that can manage forecasting applications, synchronizing supply with demand, and ensures the ordered product at the right time. It can broadly be classified under supply chain planning (SCP) and supply chain execution (SCE).

SCP systems are designed in a way to coordinate demand forecasts for products, schedule manufacturing, and provide relevant data for performance analysis. SCP software includes:

- Network Planning & Design

- Capacity Planning

- Scenario planning & real-time demand

- Manufacturing planning

Supply Chain Execution (SCE) systems are much more operational and efficient, allowing the supply chain tasks to finish quicker. SCE systems usually fall under the SCP systems and receive information from each feed, only to execute later and provide insight.

- Transport Management Systems (TMS)

- Warehouse Management Systems (WMS)

- Inventory Management Systems

- Order Processing

Do you think that Supply Chain Trends will enable the logistics managers to outperform in their company?

[yes-no-button]

Business Intelligence for Transport & Logistics

Management needs to explore tech-stack and develop business intelligence tools to measure, monitor, and track key business processes within supply chain management (SCM). The purpose is to streamline and solve complex problems with multiple solutions. The beginning of the global trade and the global transport & logistics industry demands to lead the business intelligence functions with the following sets:

- Timely Delivery of Goods.

- Transport Logistics Automation.

- Workflow Management in Real-Time.

- Interfacing with ERP, TMS, WMS, GPS.

- Automatic Route Planning (for retail distribution, LTL, transport containers, intermodal transport, etc.)

Transport Management System (TMS)

Traditional TMS use to handle the movement of trucks, facilitating the loading, pricing, routing, and costing. However, it is no longer acts as a standalone system anymore. Instead, it is now integrated with enterprise-wide resource planning system (ERPs), linking with WMS, production, sales, and marketing. With advancing technology, it is migrating to the cloud providing benefits to shippers with a smaller transportation budget.

A few of the critical functions of TMS

- Increase Business Productivity.

- Improve end-to-end visibility and service.

- Improve cash-flow for freight transportation.

- Standardize logistics processes and operations.

- Accelerate decision-making with real-time insights.

Warehouse Management System (WMS)

WMS on a wide-scale deal with day-to-day operations, order management, processing, serial number tracking, pick, pack, as well as product recalls. Nowadays, it is hosted in the cloud rather than ‘on-premises’. Consequently, a WMS will schedule the most efficient route for the picker but also need an optimal solution due to the vast amount of data and variables involved.

A few of the critical functions of WMS

- Efficiently manages and directs the pickers, order processors, and warehouse staff.

- Barcode or RFID of each stock keeping unit (SKU) to maintain type, weight, dimensions, etc.

- WMS to make informed decisions to allocate the SKU location based on fast or slow-moving.

Third-Party Logistics Provider (3PL)

A third-party logistics provider (3PL) is a supply chain model that is usually involved in a company’s logistics operation. It includes a business owner, logistics provider, & carrier. A 3PL service provider handles packaging, warehousing, and inventory management.

The reason to choose a 3PL is to efficiently manage multiple transportation solutions while also increasing the sophistication and simplicity of supply chains.

Transportation and logistics companies will need to focus on digital fitness, cost efficiency, asset productivity, and innovation if they want to meet the rapidly changing expectations of shippers and consumers.

Logistics is taking a new shape due to the power of data-driven insights. Whereas, the current technology is pumping a massive amount of data to capture from various sources along the supply chain.

Most importantly, are you confused about whether to choose a 3PL or 4PL Outsourcing? Here’s the key difference between a 3PL and 4PL logistics provider & how they can benefit your business.

Fourth-Party Logistics Provider (4PL)

A fourth-party logistics provider or 4PL is a one-step further development in logistics outsourcing. It is to bypass one-time operating cost reduction and asset transfer of a traditional outsourcing arrangement.

Usually, a 4PL service provider will act as a command center between all aspects of the supply chain and client organization. In other words, a 4PL is non-asset based, meaning it does not own transportation or warehouse assets and also referred to as Lead Logistics Partner (LLP).

With an operation-centric strategic vision, 4PL offers to create a new supply chain network that efficiently manages the flow of products across all platforms.

3PL (Third Party Logistics) VS 4PL (Fourth Party Logistics)

Is It The Best Time To Invest in Core Systems?

Old-school organizations have already made a substantial investment in core transport and logistics systems. However, due to evolving digital demands from customers and partners, it is necessary to reform and to re-align these systems. The primary purpose would be to benefit from improved efficiency & increase revenue with the lowest cost.

Core system rejuvenation is a must in today’s time. It will be a remarkable transformation journey and also an opportunity to modernize tech stack so that businesses across the globe whether big or medium or small can improvise their operating models and processes.

Wish to know, “How Top Logistic Companies are Earning in Billions with Technology Upgrade?”

Wrapping Up:

Evolving technologies coupled with significant cost reduction is a crucial factor driving the growth opportunity in the logistics business. In a similar approach, in our upcoming blog series on ‘Transport & Logistics Industry,’ we will be casting light on the digitalization, forces transforming transport & logistics, challenges, and solutions.

How To Grab A Big Pie of Transport & Logistics Economy With Digital Transformation? Part – III