Key Takeaways:

- Smarter Underwriting: AI brings intelligence to underwriting by analyzing vast financial data instantly, improving accuracy, and removing slow manual decision cycles.

- GenAI Decisions: Generative AI produces clearer, faster underwriting decisions by summarizing documents, generating risk insights, and supporting real-time evaluation.

- Risk Scoring AI: AI-driven risk scoring evaluates borrowers with greater precision using patterns across credit history, income behavior, and alternative financial data.

- Faster Approvals: Automation accelerates underwriting by reducing document review time, enabling instant eligibility checks, and speeding loan approvals for users.

- Fraud Shielding: AI detects hidden fraud signals through behavioral patterns, identity anomalies, and unusual financial activities long before traditional systems notice.

- Real-Time Analytics: AI delivers live analytics during underwriting, helping FinTech lenders react quickly to market shifts, borrower risks, and operational changes.

- Scalable Lending: AI enables scalable lending models that handle higher volumes, complex portfolios, and diverse borrower profiles with speed and accuracy.

Imagine applying for a loan and waiting weeks for a decision, only to be declined because traditional systems rely on limited insight into your full financial profile. For decades, underwriting, the gatekeeper of financial access, has relied on manual reviews, rigid rules, and credit scores that often fail to capture the whole picture. Borrowers with unconventional income streams, gig workers, or those new to credit were frequently left on the sidelines.

Now, AI is rewriting this story. AI underwriting leverages real-time data analysis and historical patterns to turn slow, biased processes into faster, more transparent, and inclusive ones. From speeding up approvals to expanding access for underserved borrowers, AI FinTech solutions are not just improving underwriting; they are redefining how the financial world decides who gets credit and how.

Read this blog to uncover the intricacies of AI underwriting: how it works, why traditional methods fall short, and its transformative impact across FinTech.

What Is Loan Underwriting?

Loan underwriting is the process that financial institutions use to determine a borrower’s eligibility for credit. It involves assessing creditworthiness, repayment ability, and overall risk profile.

Traditionally, this means reviewing credit scores, verifying income, checking debt-to-income ratios, and sometimes requiring collateral for secured loans. These steps help lenders gauge the likelihood of default. However, traditional methods are often slow and rigid, relying heavily on manual checks and static data like credit reports. This makes it difficult to capture the full picture of borrowers with limited or unconventional histories, such as freelancers or gig workers.

AI underwriting addresses these gaps by integrating real-time and alternative data with machine learning, making evaluations faster, more accurate, and more inclusive.

Why Traditional Underwriting Falls Short?

Traditional underwriting, while effective for decades, struggles to meet modern financial demands:

- Limited Inclusion: Reliance on credit scores often excludes gig workers, freelancers, and thin-file borrowers. In fact, approximately 1.7 billion people around the globe remain unbanked, according to a ScienceDirect report.

- Manual Bottlenecks: Paper-heavy processes slow approvals and increase operational costs.

- Bias and Subjectivity: Human judgment can introduce unconscious bias, denying qualified applicants access to credit.

- Slow Approvals: Traditional methods take days or weeks, falling short of today’s expectation for instant decisions.

How AI Underwriting Works?

AI underwriting transforms the traditional lending process into a dynamic, data-driven system. It integrates multiple technologies, automation, real-time data analysis, machine learning, and human oversight to assess risk efficiently and accurately. Here’s a step-by-step look at the process:

Data Ingestion

- AI gathers information from both traditional and alternative sources, including credit reports, bank feeds (via open banking), rental records, gig income, utilities, tax filings, and transaction histories.

- This ensures that borrowers with limited or unconventional credit histories can still be evaluated fairly and accurately.

Data Cleaning & Feature Engineering

Raw data is processed into meaningful signals, such as:

- Income Stability Index – consistency of earnings

- Expense Volatility Score – fluctuations in spending

- Debt Service Ratio – proportion of income allocated to debt repayment

These features provide a comprehensive snapshot of financial behavior.

Machine Learning Models

- Historical lending outcomes train AI models to predict default probability and assess borrower risk.

- Models evaluate hundreds of variables simultaneously, detecting patterns and relationships that manual processes may miss.

Document Analysis (NLP & OCR)

- Natural Language Processing and Optical Character Recognition extract and validate information from documents like pay stubs, contracts, and IDs.

- Fraud detection is embedded by spotting inconsistencies in documentation.

Real-Time Decision Engines

- APIs integrate with lending platforms to enable near-instant credit decisions.

- For example, BNPL providers can approve purchases in under two seconds.

Fraud Detection & Validation

- AI continuously monitors for anomalies, such as duplicate applications or suspicious cash flows.

- Behavioral biometrics, like typing speed or device fingerprints, add an additional layer of verification.

Human-in-the-Loop Oversight

- Complex or borderline cases are escalated to human underwriters.

- Humans provide judgment, regulatory interpretation, and ethical oversight, ensuring accountability while AI handles high-volume, repetitive tasks.

Takeaway: By combining automation, machine learning, and real-time decision-making with human oversight, AI underwriting creates a faster, more accurate, and scalable risk assessment process. Borrowers are evaluated holistically, fraud is mitigated, and lenders gain actionable insights, all in a fraction of the time that traditional methods require.

Quick Stat:

According to a 2024 KPMG survey covering 2,900 organizations across 23 countries, the adoption rate of AI in finance stands at 71%, with most institutions either running AI in production or actively piloting it.

Key Benefits of AI Underwriting

AI underwriting doesn’t just automate processes; it drives measurable improvements for lenders and borrowers.

- Faster Approvals: Decisions that used to take days or weeks can now be completed in a few minutes.

- More Accurate Risk Assessment: Leverages alternative data for a holistic understanding of borrower behavior, reducing defaults.

- Enhanced Financial Inclusion: Expands credit access to thin-file borrowers, freelancers, and gig economy workers.

- Reduced Bias & Greater Fairness: Trained on diverse datasets and enhanced with Explainable AI (XAI) for transparent decisions.

- Operational Efficiency & Cost Savings: Automation reduces labor-intensive checks, freeing underwriters for complex tasks and lowering operational costs.

In summary: AI underwriting improves speed, accuracy, inclusivity, fairness, and efficiency, making the lending process smarter and more equitable.

Quick Stat:

According to a report from Market.us, the global ‘AI in Underwriting’ market is projected to grow from USD 2.6 billion in 2023 to around USD 41.1 billion by 2033, with a CAGR of approximately 31.8%.

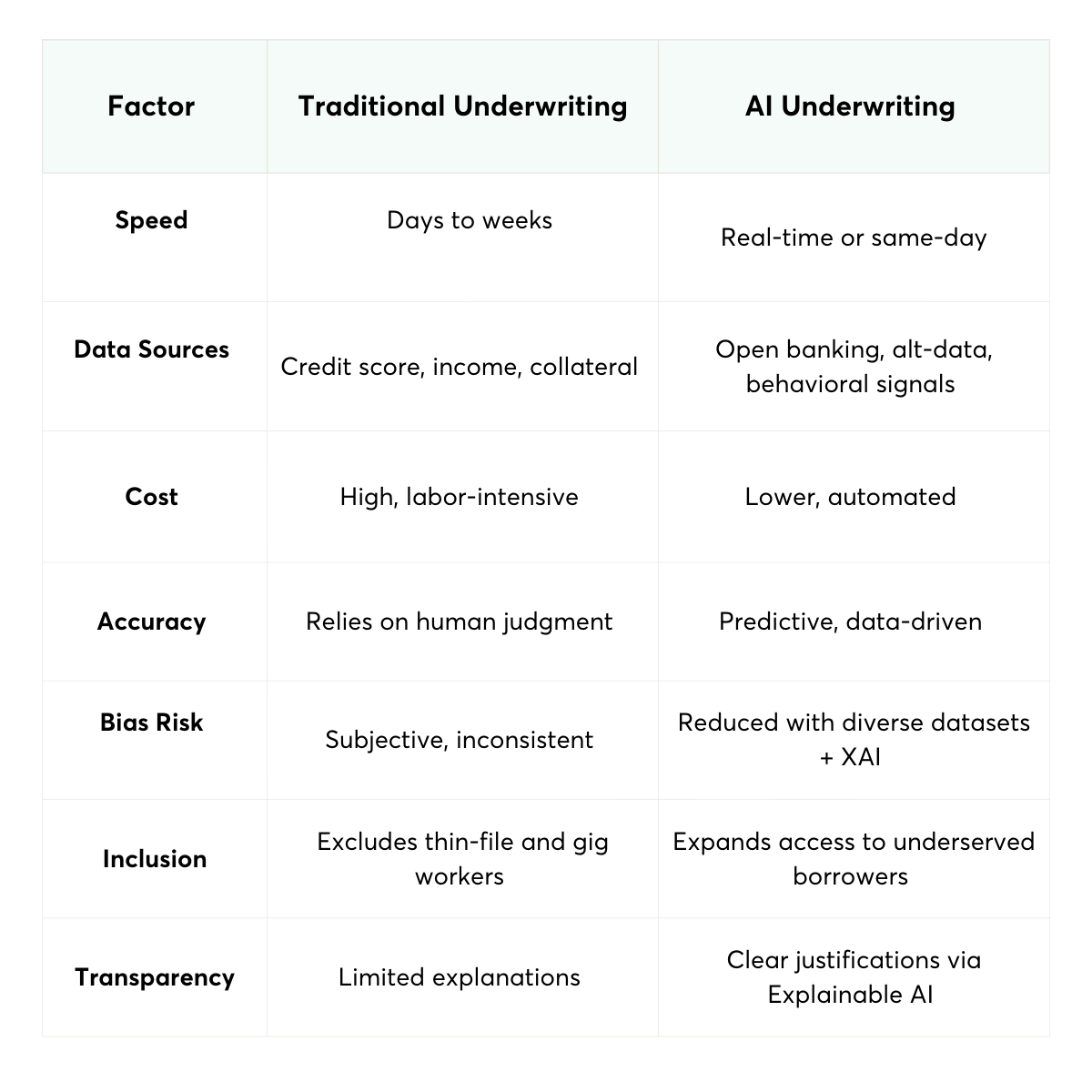

Comparison Between Traditional Loan Underwriting vs. AI Loan Underwriting

Use Cases of Modern Underwriting

AI underwriting is reshaping how financial institutions evaluate risk, approve applications, and serve customers. By leveraging machine learning models, alternative data sources, and real-time analytics, AI underwriting enables faster, more inclusive, and more precise decision-making compared to traditional methods. Below are key areas where AI is driving transformation across financial services.

1. Consumer Lending

AI credit underwriting is expanding access to borrowers who might otherwise be overlooked.

- How it works: Platforms like Upstart and SoFi analyze not only credit scores but also education, employment history, career trajectory, and income growth potential.

- Impact: This enables lending to thin-file borrowers, those with limited credit history but strong earning potential, thereby reducing dependence on legacy scoring systems, such as FICO alone.

- Outcome: Faster approvals, more personalized loan terms, and broader financial inclusion.

2. SME (Small and Medium Enterprise) Financing

Traditional lenders often reject SMEs due to inconsistent cash flow or a lack of collateral.

- How it works: AI-driven platforms review daily sales, invoices, supplier payments, tax filings, and even point-of-sale transactions to determine a business’s financial health.

- Impact: Businesses that would generally be considered “too risky” gain access to working capital loans, merchant cash advances, or invoice financing.

- Outcome: Greater support for entrepreneurship and growth in underserved business segments.

3. Mortgage Underwriting

Mortgage lending is historically complex and time-consuming. AI accelerates the process.

- How it works: Tools like Blend automate income and employment verification, property valuations, and credit assessments. Some also integrate geospatial data and housing market analytics.

- Impact: Approval timelines shrink from weeks to days, reducing borrower stress and operational costs.

- Outcome: Increased efficiency, reduced paperwork, and smoother home-buying experiences.

4. Insurance Underwriting

Insurance relies heavily on risk prediction, making it a natural fit for AI.

- Health Insurance: AI models evaluate wearable device data (heart rate, activity levels), medical records, and lifestyle habits to personalize premiums.

- Auto Insurance: Insurers use telematics data (driving speed, braking behavior, mileage, time of driving) to create usage-based insurance (UBI) products.

- Impact: More accurate pricing, better fraud detection, and incentives for healthier or safer behavior.

- Outcome: Fairer premiums and stronger customer engagement. Beyond insurance, AI wealth management platforms are also using predictive analytics to help individuals and institutions optimize investment strategies, balance risk, and personalize financial planning.

Quick Stat:

According to a recent NAIC survey, nearly half (47%) of home insurance companies are already using AI/ML in underwriting. That number jumps to 62% when including those building or planning models.

5. Buy Now, Pay Later (BNPL)

BNPL requires instant credit decisions at checkout, and AI makes this possible.

- How it works: Providers like Affirm and Klarna instantly assess borrower risk by analyzing purchase behavior, payment history, device information, and alternative credit signals.

- Impact: Real-time approvals create seamless shopping experiences without traditional delays.

- Outcome: Higher conversion rates for merchants and greater convenience for consumers.

6. Fraud Prevention

Fraudulent applications pose a significant risk to financial institutions.

- How it works: AI cross-checks identities, behavioral biometrics (typing speed, device usage), and transaction histories to detect anomalies.

- Impact: Detects synthetic identities, stolen credentials, or suspicious activity that manual checks might miss.

- Outcome: Reduced losses from fraud, stronger trust, and regulatory compliance.

7. RegTech Compliance

AI underwriting also enhances regulatory technology (RegTech) applications.

- How it works: Integrates AML (Anti-Money Laundering), KYC (Know Your Customer), and sanctions screening into underwriting workflows. AI flags high-risk profiles and ensures transactions comply with legal requirements.

- Impact: Reduces manual audit work, minimizes human error, and keeps institutions aligned with evolving global regulations.

- Outcome: Faster compliance processes and lower operational costs.

These use cases demonstrate the universality of artificial intelligence underwriting across consumer, SME, mortgage, and insurance segments.

The Regulatory Landscape of AI Underwriting

As AI-driven underwriting grows, financial institutions must ensure compliance with laws and regulations to maintain ethical, transparent, and fair practices. Key considerations include:

Data Protection Regulations

Europe – GDPR:

- Governs how personal data is collected, stored, and processed.

- Requires AI models to provide transparency and explainability for decisions.

- Ensures accountability for lenders and borrowers.

California – CCPA:

- Grants residents rights regarding the collection and use of their data.

- Requires companies to protect personal information.

- Allows individuals to opt out of having their data used in AI decision-making.

Bias and Fairness Regulations

US – Fair Lending Act:

- Requires AI underwriting models to avoid biases related to race, gender, age, or socioeconomic status.

- Ensures AI does not unintentionally discriminate against certain groups of borrowers.

Impact of Compliance

- Adhering to regulations builds trust and transparency.

- Reassures both financial institutions and customers that AI is being used responsibly and equitably.

Risks and Challenges of Using AI in Underwriting

While AI underwriting offers numerous benefits, there are key challenges that must be addressed for it to reach its full potential.

-

Data Privacy and Protection

AI underwriting relies on large datasets containing sensitive personal information. Financial institutions must ensure compliance with data protection regulations, such as GDPR and CCPA, which require secure data handling and transparency in the use of personal data. This is essential for maintaining trust and avoiding legal issues.

-

Algorithm Bias

AI models can inherit biases from training data, leading to unfair lending decisions. To prevent this, it’s crucial to train AI systems on diverse, representative datasets and use Explainable AI (XAI) to ensure transparency and fairness in decision-making.

-

Technology Bias

Integrating AI into legacy systems can be complex and costly. Financial institutions must invest in modern infrastructure and skilled personnel to ensure the smooth adoption of AI, which can require significant upfront resources and time.

Market Insight:

FinTech chatbots powered by conversational AI are enhancing customer support in lending and underwriting, answering borrower questions instantly and guiding them through applications without delays.

The Role of Humans in an AI-Driven Underwriting Future

AI won’t replace human underwriters; it will augment their capabilities.

AI Handles

- Routine document checks

- Initial risk scoring

- Fraud detection

- Dynamic data modeling

Humans Handle

- Complex or borderline cases

- Regulatory interpretation and audits

- Customer empathy and engagement

- Ethical oversight

At the same time, FinTech chatbots powered by conversational AI are enhancing customer support in lending and underwriting, answering borrower questions instantly and guiding them through applications without delays.

Conclusion

The financial industry is moving away from slow and manual underwriting toward a future where AI underwriting sets the standard. By automating risk assessment, analyzing alternative data, and enabling real-time decision-making, AI makes the process faster, more accurate, and more transparent.

For lenders, this means lower costs, stronger compliance, and more reliable loan portfolios. For borrowers, it provides fairer access to credit products that accurately reflect their true financial behaviors, whether they are freelancers, small business owners, or individuals with limited credit histories.

As FinTech continues to grow worldwide, AI underwriting will become the foundation of responsible, scalable, and inclusive finance. Organizations that embrace it early will gain a competitive advantage and contribute to building a financial system that works better for everyone. Apart from underwriting, if you would like to explore more applications of AI in FinTech, read our comprehensive blog on Real-World FinTech AI Use Cases in the industry.